Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Accounts continued<br />

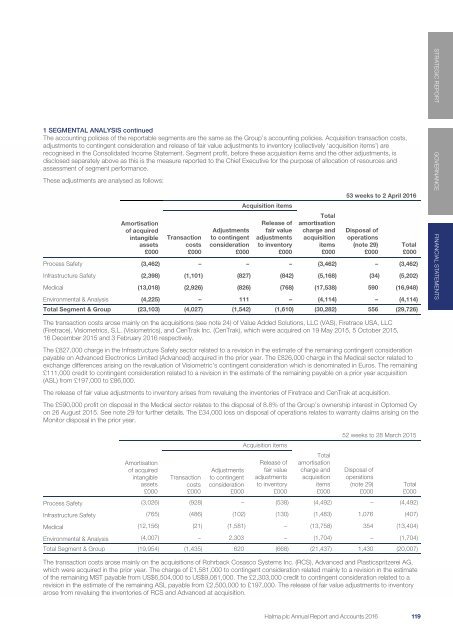

1 SEGMENTAL ANALYSIS continued<br />

The accounting policies of the reportable segments are the same as the Group’s accounting policies. Acquisition transaction costs,<br />

adjustments to contingent consideration and release of fair value adjustments to inventory (collectively ‘acquisition items’) are<br />

recognised in the Consolidated Income Statement. Segment profit, before these acquisition items and the other adjustments, is<br />

disclosed separately above as this is the measure reported to the Chief Executive for the purpose of allocation of resources and<br />

assessment of segment performance.<br />

These adjustments are analysed as follows:<br />

Amortisation<br />

of acquired<br />

intangible<br />

assets<br />

£000<br />

Transaction<br />

costs<br />

£000<br />

Adjustments<br />

to contingent<br />

consideration<br />

£000<br />

Acquisition items<br />

Release of<br />

fair value<br />

adjustments<br />

to inventory<br />

£000<br />

Total<br />

amortisation<br />

charge and<br />

acquisition<br />

items<br />

£000<br />

53 weeks to 2 April <strong>2016</strong><br />

Disposal of<br />

operations<br />

(note 29)<br />

£000<br />

Process Safety (3,462) – – – (3,462) – (3,462)<br />

Infrastructure Safety (2,398) (1,101) (827) (842) (5,168) (34) (5,202)<br />

Medical (13,018) (2,926) (826) (768) (17,538) 590 (16,948)<br />

Environmental & Analysis (4,225) – 111 – (4,114) – (4,114)<br />

Total Segment & Group (23,103) (4,027) (1,542) (1,610) (30,282) 556 (29,726)<br />

Total<br />

£000<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

The transaction costs arose mainly on the acquisitions (see note 24) of Value Added Solutions, LLC (VAS), Firetrace USA, LLC<br />

(Firetrace), Visiometrics, S.L. (Visiometrics), and CenTrak Inc. (CenTrak), which were acquired on 19 May 2015, 5 October 2015,<br />

16 December 2015 and 3 February <strong>2016</strong> respectively.<br />

The £827,000 charge in the Infrastructure Safety sector related to a revision in the estimate of the remaining contingent consideration<br />

payable on Advanced Electronics Limited (Advanced) acquired in the prior year. The £826,000 charge in the Medical sector related to<br />

exchange differences arising on the revaluation of Visiometric’s contingent consideration which is denominated in Euros. The remaining<br />

£111,000 credit to contingent consideration related to a revision in the estimate of the remaining payable on a prior year acquisition<br />

(ASL) from £197,000 to £86,000.<br />

The release of fair value adjustments to inventory arises from revaluing the inventories of Firetrace and CenTrak at acquisition.<br />

The £590,000 profit on disposal in the Medical sector relates to the disposal of 8.8% of the Group’s ownership interest in Optomed Oy<br />

on 26 August 2015. See note 29 for further details. The £34,000 loss on disposal of operations relates to warranty claims arising on the<br />

Monitor disposal in the prior year.<br />

Amortisation<br />

of acquired<br />

intangible<br />

assets<br />

£000<br />

Transaction<br />

costs<br />

£000<br />

Adjustments<br />

to contingent<br />

consideration<br />

£000<br />

Acquisition items<br />

Release of<br />

fair value<br />

adjustments<br />

to inventory<br />

£000<br />

Total<br />

amortisation<br />

charge and<br />

acquisition<br />

items<br />

£000<br />

52 weeks to 28 March 2015<br />

Disposal of<br />

operations<br />

(note 29)<br />

£000<br />

Process Safety (3,026) (928) – (538) (4,492) – (4,492)<br />

Infrastructure Safety (765) (486) (102) (130) (1,483) 1,076 (407)<br />

Medical (12,156) (21) (1,581) – (13,758) 354 (13,404)<br />

Environmental & Analysis (4,007) – 2,303 – (1,704) – (1,704)<br />

Total Segment & Group (19,954) (1,435) 620 (668) (21,437) 1,430 (20,007)<br />

The transaction costs arose mainly on the acquisitions of Rohrback Cosasco Systems Inc. (RCS), Advanced and Plasticspritzerei AG,<br />

which were acquired in the prior year. The charge of £1,581,000 to contingent consideration related mainly to a revision in the estimate<br />

of the remaining MST payable from US$6,504,000 to US$9,061,000. The £2,303,000 credit to contingent consideration related to a<br />

revision in the estimate of the remaining ASL payable from £2,500,000 to £197,000. The release of fair value adjustments to inventory<br />

arose from revaluing the inventories of RCS and Advanced at acquisition.<br />

Total<br />

£000<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 117 119