You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Accounts continued<br />

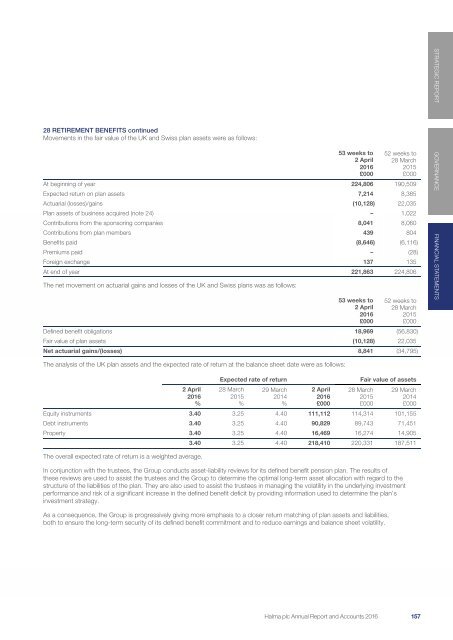

28 RETIREMENT BENEFITS continued<br />

Movements in the fair value of the UK and Swiss plan assets were as follows:<br />

The net movement on actuarial gains and losses of the UK and Swiss plans was as follows:<br />

53 weeks to<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

52 weeks to<br />

28 March<br />

2015<br />

£000<br />

At beginning of year 224,806 190,509<br />

Expected return on plan assets 7,214 8,385<br />

Actuarial (losses)/gains (10,128) 22,035<br />

Plan assets of business acquired (note 24) – 1,022<br />

Contributions from the sponsoring companies 8,041 8,060<br />

Contributions from plan members 439 804<br />

Benefits paid (8,646) (6,116)<br />

Premiums paid – (28)<br />

Foreign exchange 137 135<br />

At end of year 221,863 224,806<br />

53 weeks to<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

52 weeks to<br />

28 March<br />

2015<br />

£000<br />

Defined benefit obligations 18,969 (56,830)<br />

Fair value of plan assets (10,128) 22,035<br />

Net actuarial gains/(losses) 8,841 (34,795)<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

The analysis of the UK plan assets and the expected rate of return at the balance sheet date were as follows:<br />

2 April<br />

<strong>2016</strong><br />

%<br />

The overall expected rate of return is a weighted average.<br />

Expected rate of return<br />

28 March<br />

2015<br />

%<br />

29 March<br />

2014<br />

%<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

Fair value of assets<br />

28 March<br />

2015<br />

£000<br />

In conjunction with the trustees, the Group conducts asset-liability reviews for its defined benefit pension plan. The results of<br />

these reviews are used to assist the trustees and the Group to determine the optimal long-term asset allocation with regard to the<br />

structure of the liabilities of the plan. They are also used to assist the trustees in managing the volatility in the underlying investment<br />

performance and risk of a significant increase in the defined benefit deficit by providing information used to determine the plan’s<br />

investment strategy.<br />

As a consequence, the Group is progressively giving more emphasis to a closer return matching of plan assets and liabilities,<br />

both to ensure the long-term security of its defined benefit commitment and to reduce earnings and balance sheet volatility.<br />

29 March<br />

2014<br />

£000<br />

Equity instruments 3.40 3.25 4.40 111,112 114,314 101,155<br />

Debt instruments 3.40 3.25 4.40 90,829 89,743 71,451<br />

Property 3.40 3.25 4.40 16,469 16,274 14,905<br />

3.40 3.25 4.40 218,410 220,331 187,511<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 157 155