You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Remuneration Committee Report continued<br />

Annual Remuneration<br />

Report continued<br />

Prior to drawing his pension, to the extent that an executive’s current salary exceeds the Plan salary cap, the Company compensates him at<br />

an annual rate of 26% of the excess. In April 2006, Kevin Thompson chose to cease future service accrual in the Plan in return for the pension<br />

supplement on his full salary. In April 2014, Andrew Williams chose to cease future service accrual in the Plan in return for the pension<br />

supplement on his full salary. This change is, broadly, cost neutral.<br />

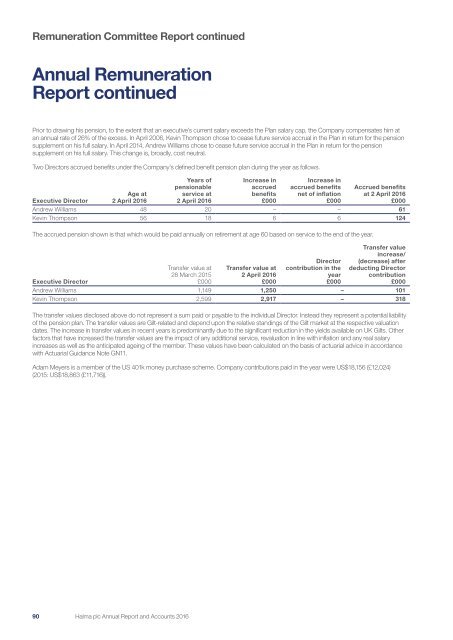

Two Directors accrued benefits under the Company’s defined benefit pension plan during the year as follows.<br />

Executive Director<br />

Age at<br />

2 April <strong>2016</strong><br />

Years of<br />

pensionable<br />

service at<br />

2 April <strong>2016</strong><br />

Increase in<br />

accrued<br />

benefits<br />

£000<br />

Increase in<br />

accrued benefits<br />

net of inflation<br />

£000<br />

Accrued benefits<br />

at 2 April <strong>2016</strong><br />

£000<br />

Andrew Williams 48 20 – – 61<br />

Kevin Thompson 56 18 6 6 124<br />

The accrued pension shown is that which would be paid annually on retirement at age 60 based on service to the end of the year.<br />

Executive Director<br />

Transfer value at<br />

28 March 2015<br />

£000<br />

Transfer value at<br />

2 April <strong>2016</strong><br />

£000<br />

Director<br />

contribution in the<br />

year<br />

£000<br />

Transfer value<br />

increase/<br />

(decrease) after<br />

deducting Director<br />

contribution<br />

£000<br />

Andrew Williams 1,149 1,250 – 101<br />

Kevin Thompson 2,599 2,917 – 318<br />

The transfer values disclosed above do not represent a sum paid or payable to the individual Director. Instead they represent a potential liability<br />

of the pension plan. The transfer values are Gilt-related and depend upon the relative standings of the Gilt market at the respective valuation<br />

dates. The increase in transfer values in recent years is predominantly due to the significant reduction in the yields available on UK Gilts. Other<br />

factors that have increased the transfer values are the impact of any additional service, revaluation in line with inflation and any real salary<br />

increases as well as the anticipated ageing of the member. These values have been calculated on the basis of actuarial advice in accordance<br />

with Actuarial Guidance Note GN11.<br />

Adam Meyers is a member of the US 401k money purchase scheme. Company contributions paid in the year were US$18,156 (£12,024)<br />

(2015: US$18,863 (£11,716)).<br />

90 <strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong>