You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Accounts continued<br />

19 PROVISIONS continued<br />

Legal, contractual and other<br />

Legal, contractual and other provisions comprise mainly amounts reserved against open legal and contractual disputes. The Company<br />

has on occasion been required to take legal or other actions to defend itself against proceedings brought by other parties. Provisions<br />

are made for the expected costs associated with such matters, based on past experience of similar items and other known factors,<br />

taking into account professional advice received, and represent Directors’ best estimate of the likely outcome. The timing of utilisation<br />

of these provisions is frequently uncertain reflecting the complexity of issues and the outcome of various court proceedings and<br />

negotiations. Contractual and other provisions represent the Directors’ best estimate of the cost of settling future obligations.<br />

Unless specific evidence exists to the contrary, these reserves are shown as current.<br />

However, no provision is made for proceedings which have been or might be brought by other parties against Group companies unless<br />

the Directors, taking into account professional advice received, assess that it is more likely than not that such proceedings may be<br />

successful.<br />

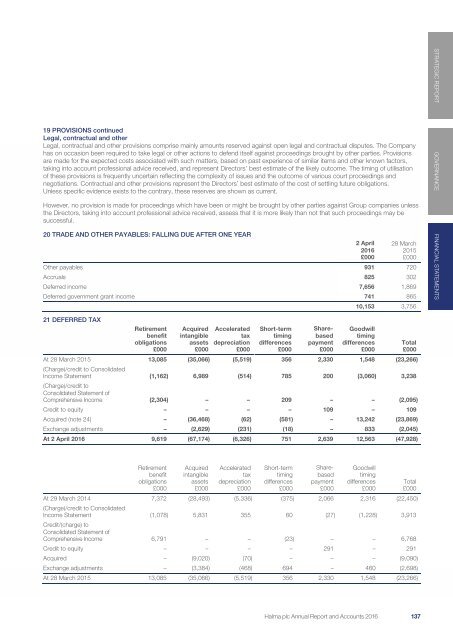

20 TRADE AND OTHER PAYABLES: FALLING DUE AFTER ONE YEAR<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

28 March<br />

2015<br />

£000<br />

Other payables 931 720<br />

Accruals 825 302<br />

Deferred income 7,656 1,869<br />

Deferred government grant income 741 865<br />

10,153 3,756<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

21 DEFERRED TAX<br />

Retirement<br />

benefit<br />

obligations<br />

£000<br />

Acquired<br />

intangible<br />

assets<br />

£000<br />

Accelerated<br />

tax<br />

depreciation<br />

£000<br />

Short-term<br />

timing<br />

differences<br />

£000<br />

Sharebased<br />

payment<br />

£000<br />

Goodwill<br />

timing<br />

differences<br />

£000<br />

At 28 March 2015 13,085 (35,066) (5,519) 356 2,330 1,548 (23,266)<br />

(Charge)/credit to Consolidated<br />

Income Statement (1,162) 6,989 (514) 785 200 (3,060) 3,238<br />

(Charge)/credit to<br />

Consolidated Statement of<br />

Comprehensive Income (2,304) – – 209 – – (2,095)<br />

Credit to equity – – – – 109 – 109<br />

Acquired (note 24) – (36,468) (62) (581) – 13,242 (23,869)<br />

Exchange adjustments – (2,629) (231) (18) – 833 (2,045)<br />

At 2 April <strong>2016</strong> 9,619 (67,174) (6,326) 751 2,639 12,563 (47,928)<br />

Total<br />

£000<br />

Retirement<br />

benefit<br />

obligations<br />

£000<br />

Acquired<br />

intangible<br />

assets<br />

£000<br />

Accelerated<br />

tax<br />

depreciation<br />

£000<br />

Short-term<br />

timing<br />

differences<br />

£000<br />

Sharebased<br />

payment<br />

£000<br />

Goodwill<br />

timing<br />

differences<br />

£000<br />

At 29 March 2014 7,372 (28,493) (5,336) (375) 2,066 2,316 (22,450)<br />

(Charge)/credit to Consolidated<br />

Income Statement (1,078) 5,831 355 60 (27) (1,228) 3,913<br />

Credit/(charge) to<br />

Consolidated Statement of<br />

Comprehensive Income 6,791 – – (23) – – 6,768<br />

Credit to equity – – – – 291 – 291<br />

Acquired – (9,020) (70) – – – (9,090)<br />

Exchange adjustments – (3,384) (468) 694 – 460 (2,698)<br />

At 28 March 2015 13,085 (35,066) (5,519) 356 2,330 1,548 (23,266)<br />

Total<br />

£000<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 137 135