You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

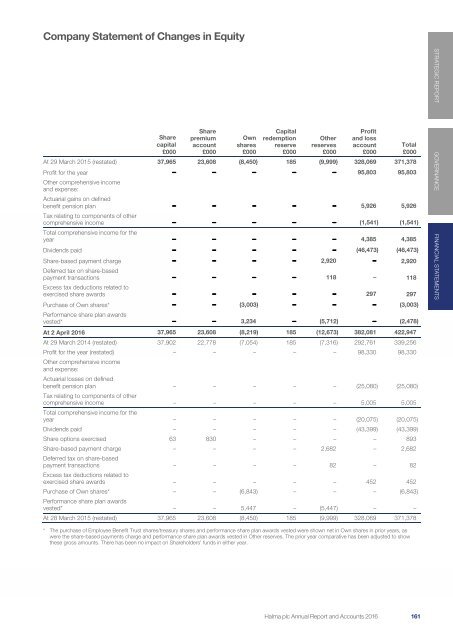

Company Statement of Changes in Equity<br />

Company Statement of Changes in Equity<br />

Share<br />

capital<br />

£000<br />

Share<br />

premium<br />

account<br />

£000<br />

Own<br />

shares<br />

£000<br />

Capital<br />

redemption<br />

reserve<br />

£000<br />

Other<br />

reserves<br />

£000<br />

Profit<br />

and loss<br />

account<br />

£000<br />

At 29 March 2015 (restated) 37,965 23,608 (8,450) 185 (9,999) 328,069 371,378<br />

Profit for the year – – – – – 95,803 95,803<br />

Other comprehensive income<br />

and expense:<br />

Actuarial gains on defined<br />

benefit pension plan – – – – – 5,926 5,926<br />

Tax relating to components of other<br />

comprehensive income – – – – – (1,541) (1,541)<br />

Total comprehensive income for the<br />

year – – – – – 4,385 4,385<br />

Dividends paid – – – – – (46,473) (46,473)<br />

Share-based payment charge – – – – 2,920 – 2,920<br />

Deferred tax on share-based<br />

payment transactions – – – – 118 – 118<br />

Excess tax deductions related to<br />

exercised share awards – – – – – 297 297<br />

Purchase of Own shares* – – (3,003) – – – (3,003)<br />

Performance share plan awards<br />

vested* – – 3,234 – (5,712) – (2,478)<br />

At 2 April <strong>2016</strong> 37,965 23,608 (8,219) 185 (12,673) 382,081 422,947<br />

At 29 March 2014 (restated) 37,902 22,778 (7,054) 185 (7,316) 292,761 339,256<br />

Profit for the year (restated) – – – – – 98,330 98,330<br />

Other comprehensive income<br />

and expense:<br />

Actuarial losses on defined<br />

benefit pension plan – – – – – (25,080) (25,080)<br />

Tax relating to components of other<br />

comprehensive income – – – – – 5,005 5,005<br />

Total comprehensive income for the<br />

year – – – – – (20,075) (20,075)<br />

Dividends paid – – – – – (43,399) (43,399)<br />

Share options exercised 63 830 – – – – 893<br />

Share-based payment charge – – – – 2,682 – 2,682<br />

Deferred tax on share-based<br />

payment transactions – – – – 82 – 82<br />

Excess tax deductions related to<br />

exercised share awards – – – – – 452 452<br />

Purchase of Own shares* – – (6,843) – – – (6,843)<br />

Performance share plan awards<br />

vested* – – 5,447 – (5,447) – –<br />

At 28 March 2015 (restated) 37,965 23,608 (8,450) 185 (9,999) 328,069 371,378<br />

Total<br />

£000<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

* The purchase of Employee Benefit Trust shares/treasury shares and performance share plan awards vested were shown net in Own shares in prior years, as<br />

were the share-based payments charge and performance share plan awards vested in Other reserves. The prior year comparative has been adjusted to show<br />

these gross amounts. There has been no impact on Shareholders’ funds in either year.<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 161 159