Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Accounts continued<br />

27 COMMITMENTS<br />

Capital commitments<br />

Capital expenditure authorised and contracted at 2 April <strong>2016</strong> but not recognised in these accounts amounts to £2,776,000<br />

(2015: £5,312,000).<br />

Commitments under operating leases<br />

The Group has entered into commercial leases on properties and other equipment. The former expire between April <strong>2016</strong> and<br />

November 2028 and the latter between April <strong>2016</strong> and July 2022. Only certain property agreements contain an option for renewal<br />

at rental prices based on market prices at the time of exercise.<br />

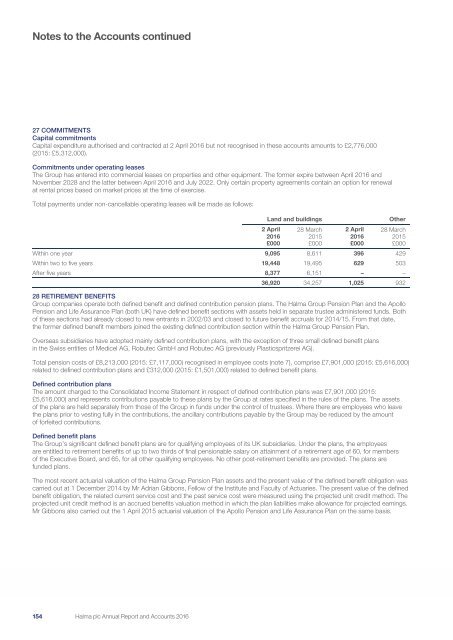

Total payments under non-cancellable operating leases will be made as follows:<br />

Land and buildings<br />

Other<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

28 March<br />

2015<br />

£000<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

28 March<br />

2015<br />

£000<br />

Within one year 9,095 8,611 396 429<br />

Within two to five years 19,448 19,495 629 503<br />

After five years 8,377 6,151 – –<br />

36,920 34,257 1,025 932<br />

28 RETIREMENT BENEFITS<br />

Group companies operate both defined benefit and defined contribution pension plans. The <strong>Halma</strong> Group Pension Plan and the Apollo<br />

Pension and Life Assurance Plan (both UK) have defined benefit sections with assets held in separate trustee administered funds. Both<br />

of these sections had already closed to new entrants in 2002/03 and closed to future benefit accruals for 2014/15. From that date,<br />

the former defined benefit members joined the existing defined contribution section within the <strong>Halma</strong> Group Pension Plan.<br />

Overseas subsidiaries have adopted mainly defined contribution plans, with the exception of three small defined benefit plans<br />

in the Swiss entities of Medicel AG, Robutec GmbH and Robutec AG (previously Plasticspritzerei AG).<br />

Total pension costs of £8,213,000 (2015: £7,117,000) recognised in employee costs (note 7), comprise £7,901,000 (2015: £5,616,000)<br />

related to defined contribution plans and £312,000 (2015: £1,501,000) related to defined benefit plans.<br />

Defined contribution plans<br />

The amount charged to the Consolidated Income Statement in respect of defined contribution plans was £7,901,000 (2015:<br />

£5,616,000) and represents contributions payable to these plans by the Group at rates specified in the rules of the plans. The assets<br />

of the plans are held separately from those of the Group in funds under the control of trustees. Where there are employees who leave<br />

the plans prior to vesting fully in the contributions, the ancillary contributions payable by the Group may be reduced by the amount<br />

of forfeited contributions.<br />

Defined benefit plans<br />

The Group’s significant defined benefit plans are for qualifying employees of its UK subsidiaries. Under the plans, the employees<br />

are entitled to retirement benefits of up to two thirds of final pensionable salary on attainment of a retirement age of 60, for members<br />

of the Executive Board, and 65, for all other qualifying employees. No other post-retirement benefits are provided. The plans are<br />

funded plans.<br />

The most recent actuarial valuation of the <strong>Halma</strong> Group Pension Plan assets and the present value of the defined benefit obligation was<br />

carried out at 1 December 2014 by Mr Adrian Gibbons, Fellow of the Institute and Faculty of Actuaries. The present value of the defined<br />

benefit obligation, the related current service cost and the past service cost were measured using the projected unit credit method. The<br />

projected unit credit method is an accrued benefits valuation method in which the plan liabilities make allowance for projected earnings.<br />

Mr Gibbons also carried out the 1 April 2015 actuarial valuation of the Apollo Pension and Life Assurance Plan on the same basis.<br />

154 152<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong>