You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

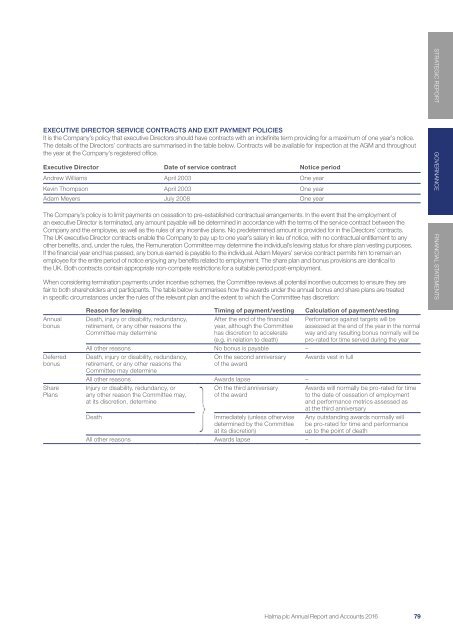

EXECUTIVE DIRECTOR SERVICE CONTRACTS AND EXIT PAYMENT POLICIES<br />

It is the Company’s policy that executive Directors should have contracts with an indefinite term providing for a maximum of one year’s notice.<br />

The details of the Directors’ contracts are summarised in the table below. Contracts will be available for inspection at the AGM and throughout<br />

the year at the Company’s registered office.<br />

Executive Director Date of service contract Notice period<br />

Andrew Williams April 2003 One year<br />

Kevin Thompson April 2003 One year<br />

Adam Meyers July 2008 One year<br />

The Company’s policy is to limit payments on cessation to pre-established contractual arrangements. In the event that the employment of<br />

an executive Director is terminated, any amount payable will be determined in accordance with the terms of the service contract between the<br />

Company and the employee, as well as the rules of any incentive plans. No predetermined amount is provided for in the Directors’ contracts.<br />

The UK executive Director contracts enable the Company to pay up to one year’s salary in lieu of notice, with no contractual entitlement to any<br />

other benefits, and, under the rules, the Remuneration Committee may determine the individual’s leaving status for share plan vesting purposes.<br />

If the financial year end has passed, any bonus earned is payable to the individual. Adam Meyers’ service contract permits him to remain an<br />

employee for the entire period of notice enjoying any benefits related to employment. The share plan and bonus provisions are identical to<br />

the UK. Both contracts contain appropriate non-compete restrictions for a suitable period post-employment.<br />

When considering termination payments under incentive schemes, the Committee reviews all potential incentive outcomes to ensure they are<br />

fair to both shareholders and participants. The table below summarises how the awards under the annual bonus and share plans are treated<br />

in specific circumstances under the rules of the relevant plan and the extent to which the Committee has discretion:<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

Annual<br />

bonus<br />

Deferred<br />

bonus<br />

Share<br />

Plans<br />

Reason for leaving Timing of payment/vesting Calculation of payment/vesting<br />

Death, injury or disability, redundancy,<br />

retirement, or any other reasons the<br />

Committee may determine<br />

After the end of the financial<br />

year, although the Committee<br />

has discretion to accelerate<br />

(e.g. in relation to death)<br />

All other reasons No bonus is payable –<br />

Death, injury or disability, redundancy, On the second anniversary Awards vest in full<br />

retirement, or any other reasons the<br />

of the award<br />

Committee may determine<br />

All other reasons Awards lapse –<br />

Injury or disability, redundancy, or<br />

any other reason the Committee may,<br />

at its discretion, determine<br />

Death<br />

On the third anniversary<br />

of the award<br />

Immediately (unless otherwise<br />

determined by the Committee<br />

at its discretion)<br />

All other reasons Awards lapse –<br />

Performance against targets will be<br />

assessed at the end of the year in the normal<br />

way and any resulting bonus normally will be<br />

pro-rated for time served during the year<br />

Awards will normally be pro-rated for time<br />

to the date of cessation of employment<br />

and performance metrics assessed as<br />

at the third anniversary<br />

Any outstanding awards normally will<br />

be pro-rated for time and performance<br />

up to the point of death<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 79