Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Accounts continued<br />

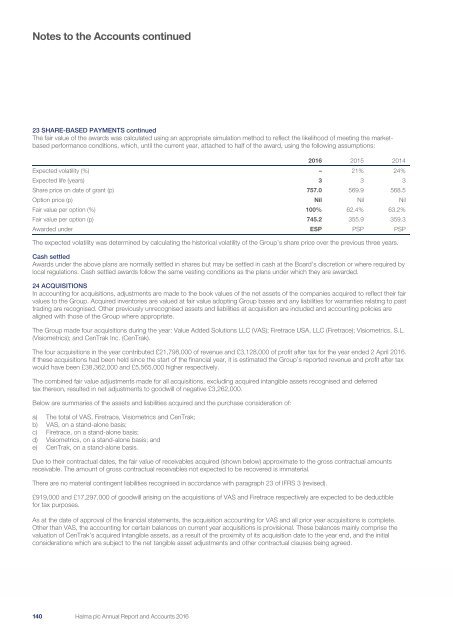

23 SHARE-BASED PAYMENTS continued<br />

The fair value of the awards was calculated using an appropriate simulation method to reflect the likelihood of meeting the marketbased<br />

performance conditions, which, until the current year, attached to half of the award, using the following assumptions:<br />

<strong>2016</strong> 2015 2014<br />

Expected volatility (%) – 21% 24%<br />

Expected life (years) 3 3 3<br />

Share price on date of grant (p) 757.0 569.9 568.5<br />

Option price (p) Nil Nil Nil<br />

Fair value per option (%) 100% 62.4% 63.2%<br />

Fair value per option (p) 745.2 355.9 359.3<br />

Awarded under ESP PSP PSP<br />

The expected volatility was determined by calculating the historical volatility of the Group’s share price over the previous three years.<br />

Cash settled<br />

Awards under the above plans are normally settled in shares but may be settled in cash at the Board’s discretion or where required by<br />

local regulations. Cash settled awards follow the same vesting conditions as the plans under which they are awarded.<br />

24 ACQUISITIONS<br />

In accounting for acquisitions, adjustments are made to the book values of the net assets of the companies acquired to reflect their fair<br />

values to the Group. Acquired inventories are valued at fair value adopting Group bases and any liabilities for warranties relating to past<br />

trading are recognised. Other previously unrecognised assets and liabilities at acquisition are included and accounting policies are<br />

aligned with those of the Group where appropriate.<br />

The Group made four acquisitions during the year: Value Added Solutions LLC (VAS); Firetrace USA, LLC (Firetrace); Visiometrics, S.L.<br />

(Visiometrics); and CenTrak Inc. (CenTrak).<br />

The four acquisitions in the year contributed £21,798,000 of revenue and £3,128,000 of profit after tax for the year ended 2 April <strong>2016</strong>.<br />

If these acquisitions had been held since the start of the financial year, it is estimated the Group’s reported revenue and profit after tax<br />

would have been £38,362,000 and £5,565,000 higher respectively.<br />

The combined fair value adjustments made for all acquisitions, excluding acquired intangible assets recognised and deferred<br />

tax thereon, resulted in net adjustments to goodwill of negative £3,262,000.<br />

Below are summaries of the assets and liabilities acquired and the purchase consideration of:<br />

a) The total of VAS, Firetrace, Visiometrics and CenTrak;<br />

b) VAS, on a stand-alone basis;<br />

c) Firetrace, on a stand-alone basis;<br />

d) Visiometrics, on a stand-alone basis; and<br />

e) CenTrak, on a stand-alone basis.<br />

Due to their contractual dates, the fair value of receivables acquired (shown below) approximate to the gross contractual amounts<br />

receivable. The amount of gross contractual receivables not expected to be recovered is immaterial.<br />

There are no material contingent liabilities recognised in accordance with paragraph 23 of IFRS 3 (revised).<br />

£919,000 and £17,297,000 of goodwill arising on the acquisitions of VAS and Firetrace respectively are expected to be deductible<br />

for tax purposes.<br />

As at the date of approval of the financial statements, the acquisition accounting for VAS and all prior year acquisitions is complete.<br />

Other than VAS, the accounting for certain balances on current year acquisitions is provisional. These balances mainly comprise the<br />

valuation of CenTrak’s acquired intangible assets, as a result of the proximity of its acquisition date to the year end, and the initial<br />

considerations which are subject to the net tangible asset adjustments and other contractual clauses being agreed.<br />

140 138<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong>