You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Accounts continued<br />

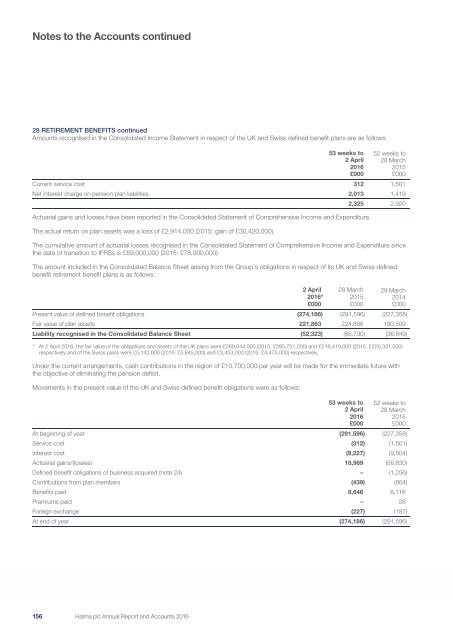

28 RETIREMENT BENEFITS continued<br />

Amounts recognised in the Consolidated Income Statement in respect of the UK and Swiss defined benefit plans are as follows:<br />

Actuarial gains and losses have been reported in the Consolidated Statement of Comprehensive Income and Expenditure.<br />

The actual return on plan assets was a loss of £2,914,000 (2015: gain of £30,420,000).<br />

The cumulative amount of actuarial losses recognised in the Consolidated Statement of Comprehensive Income and Expenditure since<br />

the date of transition to IFRSs is £69,000,000 (2015: £78,000,000).<br />

The amount included in the Consolidated Balance Sheet arising from the Group’s obligations in respect of its UK and Swiss defined<br />

benefit retirement benefit plans is as follows:<br />

* At 2 April <strong>2016</strong>, the fair value of the obligations and assets of the UK plans were £269,044,000 (2015: £285,751,000) and £218,410,000 (2015: £220,331,000)<br />

respectively and of the Swiss plans were £5,142,000 (2015: £5,845,000) and £3,453,000 (2015: £4,475,000) respectively.<br />

Under the current arrangements, cash contributions in the region of £10,700,000 per year will be made for the immediate future with<br />

the objective of eliminating the pension deficit.<br />

Movements in the present value of the UK and Swiss defined benefit obligations were as follows:<br />

53 weeks to<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

52 weeks to<br />

28 March<br />

2015<br />

£000<br />

Current service cost 312 1,501<br />

Net interest charge on pension plan liabilities 2,013 1,419<br />

2,325 2,920<br />

2 April<br />

<strong>2016</strong>*<br />

£000<br />

28 March<br />

2015<br />

£000<br />

29 March<br />

2014<br />

£000<br />

Present value of defined benefit obligations (274,186) (291,596) (227,358)<br />

Fair value of plan assets 221,863 224,806 190,509<br />

Liability recognised in the Consolidated Balance Sheet (52,323) (66,790) (36,849)<br />

53 weeks to<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

52 weeks to<br />

28 March<br />

2015<br />

£000<br />

At beginning of year (291,596) (227,358)<br />

Service cost (312) (1,501)<br />

Interest cost (9,227) (9,804)<br />

Actuarial gains/(losses) 18,969 (56,830)<br />

Defined benefit obligations of business acquired (note 24) – (1,256)<br />

Contributions from plan members (439) (804)<br />

Benefits paid 8,646 6,116<br />

Premiums paid – 28<br />

Foreign exchange (227) (187)<br />

At end of year (274,186) (291,596)<br />

156 154<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong>