Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to to the the Accounts continued<br />

24 ACQUISITIONS continued<br />

(E) CenTrak, Inc. continued<br />

The excess of the fair value of the consideration paid over the fair value of the assets acquired is represented by customer related<br />

intangibles of £21,615,000; and technology related intangibles of £24,287,000; with residual goodwill arising of £66,413,000.<br />

The residual goodwill represents:<br />

a) the technical expertise of the acquired workforce;<br />

b) the opportunity to leverage this expertise across some of <strong>Halma</strong>’s businesses; and<br />

c) the ability to exploit the Group’s existing customer base.<br />

The CenTrak acquisition contributed £4,220,000 of revenue and £333,000 of profit after tax for the year ended 2 April <strong>2016</strong>. If this<br />

acquisition had been held since the start of the financial year, it is estimated that the Group’s reported revenue and profit after tax<br />

would have been £23,947,000 and £2,621,000 higher respectively.<br />

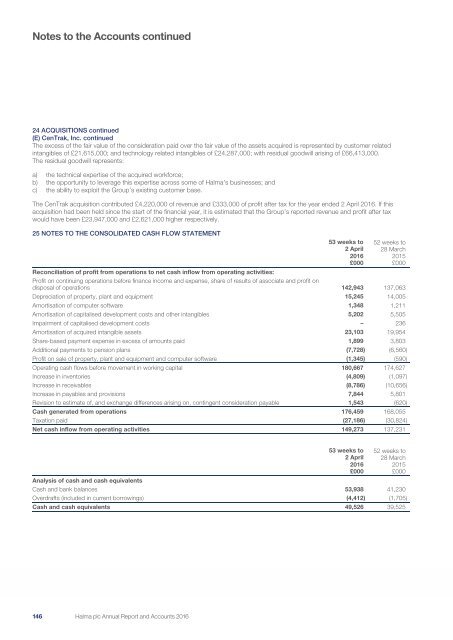

25 NOTES TO THE CONSOLIDATED CASH FLOW STATEMENT<br />

53 weeks to<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

52 weeks to<br />

28 March<br />

2015<br />

£000<br />

Reconciliation of profit from operations to net cash inflow from operating activities:<br />

Profit on continuing operations before finance income and expense, share of results of associate and profit on<br />

disposal of operations 142,943 137,063<br />

Depreciation of property, plant and equipment 15,245 14,005<br />

Amortisation of computer software 1,348 1,211<br />

Amortisation of capitalised development costs and other intangibles 5,202 5,505<br />

Impairment of capitalised development costs – 236<br />

Amortisation of acquired intangible assets 23,103 19,954<br />

Share-based payment expense in excess of amounts paid 1,899 3,803<br />

Additional payments to pension plans (7,728) (6,560)<br />

Profit on sale of property, plant and equipment and computer software (1,345) (590)<br />

Operating cash flows before movement in working capital 180,667 174,627<br />

Increase in inventories (4,809) (1,097)<br />

Increase in receivables (8,786) (10,656)<br />

Increase in payables and provisions 7,844 5,801<br />

Revision to estimate of, and exchange differences arising on, contingent consideration payable 1,543 (620)<br />

Cash generated from operations 176,459 168,055<br />

Taxation paid (27,186) (30,824)<br />

Net cash inflow from operating activities 149,273 137,231<br />

53 weeks to<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

52 weeks to<br />

28 March<br />

2015<br />

£000<br />

Analysis of cash and cash equivalents<br />

Cash and bank balances 53,938 41,230<br />

Overdrafts (included in current borrowings) (4,412) (1,705)<br />

Cash and cash equivalents 49,526 39,525<br />

146 144<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong>