You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Accounts continued<br />

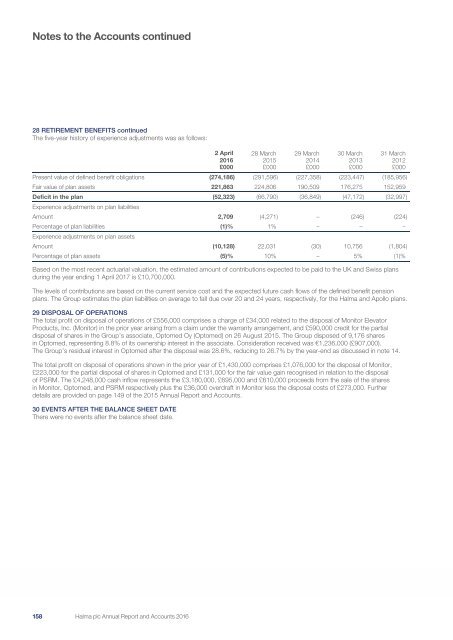

28 RETIREMENT BENEFITS continued<br />

The five-year history of experience adjustments was as follows:<br />

Based on the most recent actuarial valuation, the estimated amount of contributions expected to be paid to the UK and Swiss plans<br />

during the year ending 1 April 2017 is £10,700,000.<br />

The levels of contributions are based on the current service cost and the expected future cash flows of the defined benefit pension<br />

plans. The Group estimates the plan liabilities on average to fall due over 20 and 24 years, respectively, for the <strong>Halma</strong> and Apollo plans.<br />

29 DISPOSAL OF OPERATIONS<br />

The total profit on disposal of operations of £556,000 comprises a charge of £34,000 related to the disposal of Monitor Elevator<br />

Products, Inc. (Monitor) in the prior year arising from a claim under the warranty arrangement, and £590,000 credit for the partial<br />

disposal of shares in the Group’s associate, Optomed Oy (Optomed) on 26 August 2015. The Group disposed of 9,176 shares<br />

in Optomed, representing 8.8% of its ownership interest in the associate. Consideration received was €1,236,000 (£907,000).<br />

The Group’s residual interest in Optomed after the disposal was 28.6%, reducing to 26.7% by the year-end as discussed in note 14.<br />

The total profit on disposal of operations shown in the prior year of £1,430,000 comprises £1,076,000 for the disposal of Monitor,<br />

£223,000 for the partial disposal of shares in Optomed and £131,000 for the fair value gain recognised in relation to the disposal<br />

of PSRM. The £4,248,000 cash inflow represents the £3,180,000, £695,000 and £610,000 proceeds from the sale of the shares<br />

in Monitor, Optomed, and PSRM respectively plus the £36,000 overdraft in Monitor less the disposal costs of £273,000. Further<br />

details are provided on page 149 of the 2015 Annual Report and Accounts.<br />

30 EVENTS AFTER THE BALANCE SHEET DATE<br />

There were no events after the balance sheet date.<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

28 March<br />

2015<br />

£000<br />

29 March<br />

2014<br />

£000<br />

30 March<br />

2013<br />

£000<br />

31 March<br />

2012<br />

£000<br />

Present value of defined benefit obligations (274,186) (291,596) (227,358) (223,447) (185,956)<br />

Fair value of plan assets 221,863 224,806 190,509 176,275 152,959<br />

Deficit in the plan (52,323) (66,790) (36,849) (47,172) (32,997)<br />

Experience adjustments on plan liabilities<br />

Amount 2,709 (4,271) – (246) (224)<br />

Percentage of plan liabilities (1)% 1% – – –<br />

Experience adjustments on plan assets<br />

Amount (10,128) 22,031 (30) 10,756 (1,804)<br />

Percentage of plan assets (5)% 10% – 5% (1)%<br />

158 156<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong>