You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Accounts continued<br />

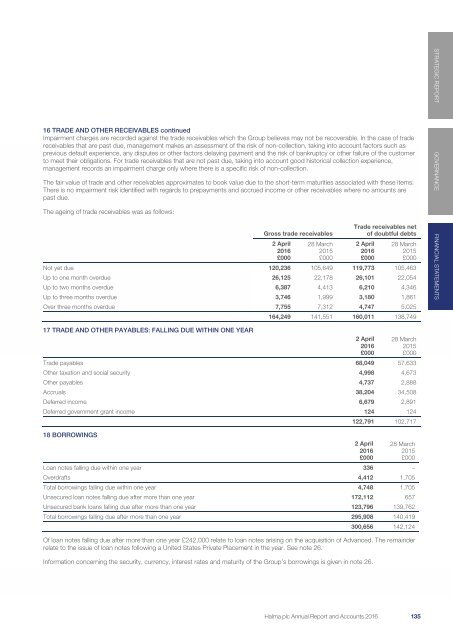

16 TRADE AND OTHER RECEIVABLES continued<br />

Impairment charges are recorded against the trade receivables which the Group believes may not be recoverable. In the case of trade<br />

receivables that are past due, management makes an assessment of the risk of non-collection, taking into account factors such as<br />

previous default experience, any disputes or other factors delaying payment and the risk of bankruptcy or other failure of the customer<br />

to meet their obligations. For trade receivables that are not past due, taking into account good historical collection experience,<br />

management records an impairment charge only where there is a specific risk of non-collection.<br />

The fair value of trade and other receivables approximates to book value due to the short-term maturities associated with these items.<br />

There is no impairment risk identified with regards to prepayments and accrued income or other receivables where no amounts are<br />

past due.<br />

The ageing of trade receivables was as follows:<br />

Gross trade receivables<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

28 March<br />

2015<br />

£000<br />

Trade receivables net<br />

of doubtful debts<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

28 March<br />

2015<br />

£000<br />

Not yet due 120,236 105,649 119,773 105,463<br />

Up to one month overdue 26,125 22,178 26,101 22,054<br />

Up to two months overdue 6,387 4,413 6,210 4,346<br />

Up to three months overdue 3,746 1,999 3,180 1,861<br />

Over three months overdue 7,755 7,312 4,747 5,025<br />

164,249 141,551 160,011 138,749<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

17 TRADE AND OTHER PAYABLES: FALLING DUE WITHIN ONE YEAR<br />

18 BORROWINGS<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

Of loan notes falling due after more than one year £242,000 relate to loan notes arising on the acquisition of Advanced. The remainder<br />

relate to the issue of loan notes following a United States Private Placement in the year. See note 26.<br />

Information concerning the security, currency, interest rates and maturity of the Group’s borrowings is given in note 26.<br />

28 March<br />

2015<br />

£000<br />

Trade payables 68,049 57,633<br />

Other taxation and social security 4,998 4,673<br />

Other payables 4,737 2,888<br />

Accruals 38,204 34,508<br />

Deferred income 6,679 2,891<br />

Deferred government grant income 124 124<br />

122,791 102,717<br />

2 April<br />

<strong>2016</strong><br />

£000<br />

28 March<br />

2015<br />

£000<br />

Loan notes falling due within one year 336 –<br />

Overdrafts 4,412 1,705<br />

Total borrowings falling due within one year 4,748 1,705<br />

Unsecured loan notes falling due after more than one year 172,112 657<br />

Unsecured bank loans falling due after more than one year 123,796 139,762<br />

Total borrowings falling due after more than one year 295,908 140,419<br />

300,656 142,124<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 135 133