You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Remuneration Committee Report continued<br />

Remuneration Policy<br />

continued<br />

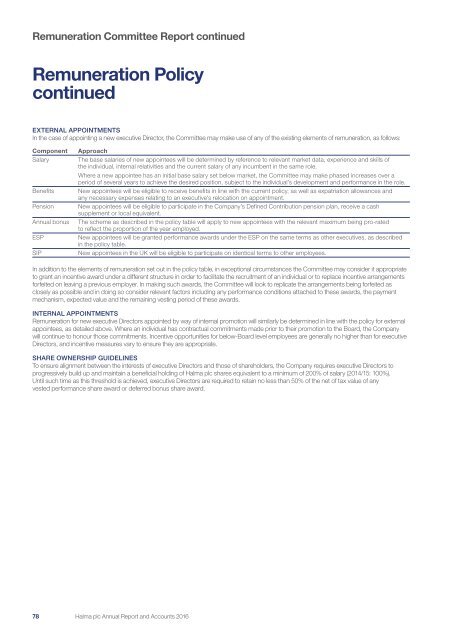

EXTERNAL APPOINTMENTS<br />

In the case of appointing a new executive Director, the Committee may make use of any of the existing elements of remuneration, as follows:<br />

Component<br />

Salary<br />

Benefits<br />

Pension<br />

Annual bonus<br />

ESP<br />

SIP<br />

Approach<br />

The base salaries of new appointees will be determined by reference to relevant market data, experience and skills of<br />

the individual, internal relativities and the current salary of any incumbent in the same role.<br />

Where a new appointee has an initial base salary set below market, the Committee may make phased increases over a<br />

period of several years to achieve the desired position, subject to the individual’s development and performance in the role.<br />

New appointees will be eligible to receive benefits in line with the current policy, as well as expatriation allowances and<br />

any necessary expenses relating to an executive’s relocation on appointment.<br />

New appointees will be eligible to participate in the Company’s Defined Contribution pension plan, receive a cash<br />

supplement or local equivalent.<br />

The scheme as described in the policy table will apply to new appointees with the relevant maximum being pro-rated<br />

to reflect the proportion of the year employed.<br />

New appointees will be granted performance awards under the ESP on the same terms as other executives, as described<br />

in the policy table.<br />

New appointees in the UK will be eligible to participate on identical terms to other employees.<br />

In addition to the elements of remuneration set out in the policy table, in exceptional circumstances the Committee may consider it appropriate<br />

to grant an incentive award under a different structure in order to facilitate the recruitment of an individual or to replace incentive arrangements<br />

forfeited on leaving a previous employer. In making such awards, the Committee will look to replicate the arrangements being forfeited as<br />

closely as possible and in doing so consider relevant factors including any performance conditions attached to these awards, the payment<br />

mechanism, expected value and the remaining vesting period of these awards.<br />

INTERNAL APPOINTMENTS<br />

Remuneration for new executive Directors appointed by way of internal promotion will similarly be determined in line with the policy for external<br />

appointees, as detailed above. Where an individual has contractual commitments made prior to their promotion to the Board, the Company<br />

will continue to honour those commitments. Incentive opportunities for below-Board level employees are generally no higher than for executive<br />

Directors, and incentive measures vary to ensure they are appropriate.<br />

SHARE OWNERSHIP GUIDELINES<br />

To ensure alignment between the interests of executive Directors and those of shareholders, the Company requires executive Directors to<br />

progressively build up and maintain a beneficial holding of <strong>Halma</strong> plc shares equivalent to a minimum of 200% of salary (2014/15: 100%).<br />

Until such time as this threshold is achieved, executive Directors are required to retain no less than 50% of the net of tax value of any<br />

vested performance share award or deferred bonus share award.<br />

78 <strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong>