Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

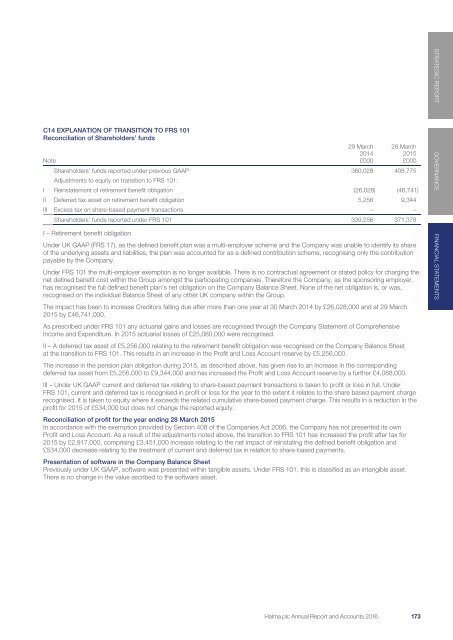

C14 EXPLANATION OF TRANSITION TO FRS 101<br />

Reconciliation of Shareholders’ funds<br />

29 March 28 March<br />

2014 2015<br />

Note<br />

£000 £000<br />

Shareholders’ funds reported under previous GAAP 360,028 408,775<br />

Adjustments to equity on transition to FRS 101:<br />

I Reinstatement of retirement benefit obligation (26,028) (46,741)<br />

II Deferred tax asset on retirement benefit obligation 5,256 9,344<br />

III Excess tax on share-based payment transactions – –<br />

Shareholders’ funds reported under FRS 101 339,256 371,378<br />

I – Retirement benefit obligation<br />

Under UK GAAP (FRS 17), as the defined benefit plan was a multi-employer scheme and the Company was unable to identify its share<br />

of the underlying assets and liabilities, the plan was accounted for as a defined contribution scheme, recognising only the contribution<br />

payable by the Company.<br />

Under FRS 101 the multi-employer exemption is no longer available. There is no contractual agreement or stated policy for charging the<br />

net defined benefit cost within the Group amongst the participating companies. Therefore the Company, as the sponsoring employer,<br />

has recognised the full defined benefit plan’s net obligation on the Company Balance Sheet. None of the net obligation is, or was,<br />

recognised on the individual Balance Sheet of any other UK company within the Group.<br />

The impact has been to increase Creditors falling due after more than one year at 30 March 2014 by £26,028,000 and at 29 March<br />

2015 by £46,741,000.<br />

As prescribed under FRS 101 any actuarial gains and losses are recognised through the Company Statement of Comprehensive<br />

Income and Expenditure. In 2015 actuarial losses of £25,080,000 were recognised.<br />

II – A deferred tax asset of £5,256,000 relating to the retirement benefit obligation was recognised on the Company Balance Sheet<br />

at the transition to FRS 101. This results in an increase in the Profit and Loss Account reserve by £5,256,000.<br />

The increase in the pension plan obligation during 2015, as described above, has given rise to an increase in the corresponding<br />

deferred tax asset from £5,256,000 to £9,344,000 and has increased the Profit and Loss Account reserve by a further £4,088,000.<br />

III – Under UK GAAP current and deferred tax relating to share-based payment transactions is taken to profit or loss in full. Under<br />

FRS 101, current and deferred tax is recognised in profit or loss for the year to the extent it relates to the share based payment charge<br />

recognised. It is taken to equity where it exceeds the related cumulative share-based payment charge. This results in a reduction in the<br />

profit for 2015 of £534,000 but does not change the reported equity.<br />

Reconciliation of profit for the year ending 28 March 2015<br />

In accordance with the exemption provided by Section 408 of the Companies Act 2006, the Company has not presented its own<br />

Profit and Loss Account. As a result of the adjustments noted above, the transition to FRS 101 has increased the profit after tax for<br />

2015 by £2,917,000, comprising £3,451,000 increase relating to the net impact of reinstating the defined benefit obligation and<br />

£534,000 decrease relating to the treatment of current and deferred tax in relation to share-based payments.<br />

Presentation of software in the Company Balance Sheet<br />

Previously under UK GAAP, software was presented within tangible assets. Under FRS 101, this is classified as an intangible asset.<br />

There is no change in the value ascribed to the software asset.<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 173 171