You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Accounts continued<br />

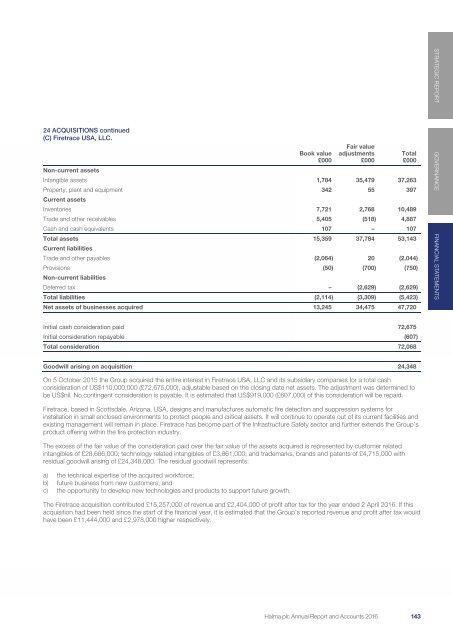

24 ACQUISITIONS continued<br />

(C) Firetrace USA, LLC.<br />

Non-current assets<br />

Book value<br />

£000<br />

Fair value<br />

adjustments<br />

£000<br />

Intangible assets 1,784 35,479 37,263<br />

Property, plant and equipment 342 55 397<br />

Current assets<br />

Inventories 7,721 2,768 10,489<br />

Trade and other receivables 5,405 (518) 4,887<br />

Cash and cash equivalents 107 – 107<br />

Total assets 15,359 37,784 53,143<br />

Current liabilities<br />

Trade and other payables (2,064) 20 (2,044)<br />

Provisions (50) (700) (750)<br />

Non-current liabilities<br />

Deferred tax – (2,629) (2,629)<br />

Total liabilities (2,114) (3,309) (5,423)<br />

Net assets of businesses acquired 13,245 34,475 47,720<br />

Total<br />

£000<br />

STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS<br />

Initial cash consideration paid 72,675<br />

Initial consideration repayable (607)<br />

Total consideration 72,068<br />

Goodwill arising on acquisition 24,348<br />

On 5 October 2015 the Group acquired the entire interest in Firetrace USA, LLC and its subsidiary companies for a total cash<br />

consideration of US$110,000,000 (£72,675,000), adjustable based on the closing date net assets. The adjustment was determined to<br />

be US$nil. No contingent consideration is payable. It is estimated that US$919,000 (£607,000) of this consideration will be repaid.<br />

Firetrace, based in Scottsdale, Arizona, USA, designs and manufactures automatic fire detection and suppression systems for<br />

installation in small enclosed environments to protect people and critical assets. It will continue to operate out of its current facilities and<br />

existing management will remain in place. Firetrace has become part of the Infrastructure Safety sector and further extends the Group’s<br />

product offering within the fire protection industry.<br />

The excess of the fair value of the consideration paid over the fair value of the assets acquired is represented by customer related<br />

intangibles of £28,686,000; technology related intangibles of £3,861,000; and trademarks, brands and patents of £4,715,000 with<br />

residual goodwill arising of £24,348,000. The residual goodwill represents:<br />

a) the technical expertise of the acquired workforce;<br />

b) future business from new customers; and<br />

c) the opportunity to develop new technologies and products to support future growth.<br />

The Firetrace acquisition contributed £15,257,000 of revenue and £2,404,000 of profit after tax for the year ended 2 April <strong>2016</strong>. If this<br />

acquisition had been held since the start of the financial year, it is estimated that the Group’s reported revenue and profit after tax would<br />

have been £11,444,000 and £2,978,000 higher respectively.<br />

<strong>Halma</strong> plc Annual Report and Accounts <strong>2016</strong> 143 141