EDC 2014 SR (UPDATED)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

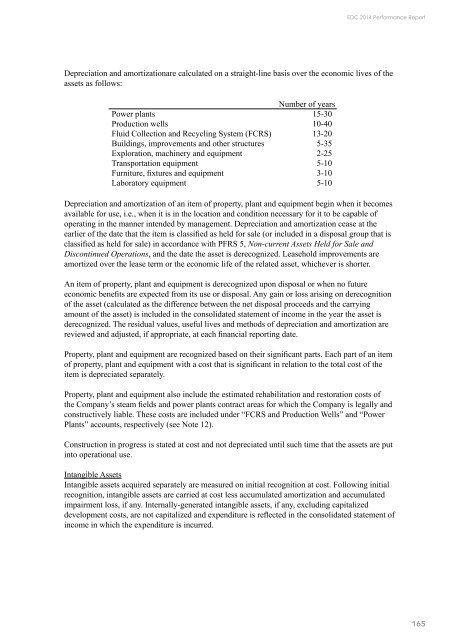

Depreciation and amortizationare calculated on a straight-line basis over the economic lives of the<br />

assets as follows:<br />

Number of years<br />

Power plants 15-30<br />

Production wells 10-40<br />

Fluid Collection and Recycling System (FCRS) 13-20<br />

Buildings, improvements and other structures 5-35<br />

Exploration, machinery and equipment 2-25<br />

Transportation equipment 5-10<br />

Furniture, fixtures and equipment 3-10<br />

Laboratory equipment 5-10<br />

Depreciation and amortization of an item of property, plant and equipment begin when it becomes<br />

available for use, i.e., when it is in the location and condition necessary for it to be capable of<br />

operating in the manner intended by management. Depreciation and amortization cease at the<br />

earlier of the date that the item is classified as held for sale (or included in a disposal group that is<br />

classified as held for sale) in accordance with PFRS 5, Non-current Assets Held for Sale and<br />

Discontinued Operations, and the date the asset is derecognized. Leasehold improvements are<br />

amortized over the lease term or the economic life of the related asset, whichever is shorter.<br />

An item of property, plant and equipment is derecognized upon disposal or when no future<br />

economic benefits are expected from its use or disposal. Any gain or loss arising on derecognition<br />

of the asset (calculated as the difference between the net disposal proceeds and the carrying<br />

amount of the asset) is included in the consolidated statement of income in the year the asset is<br />

derecognized. The residual values, useful lives and methods of depreciation and amortization are<br />

reviewed and adjusted, if appropriate, at each financial reporting date.<br />

Property, plant and equipment are recognized based on their significant parts. Each part of an item<br />

of property, plant and equipment with a cost that is significant in relation to the total cost of the<br />

item is depreciated separately.<br />

Property, plant and equipment also include the estimated rehabilitation and restoration costs of<br />

the Company’s steam fields and power plants contract areas for which the Company is legally and<br />

constructively liable. These costs are included under “FCRS and Production Wells” and “Power<br />

Plants” accounts, respectively (see Note 12).<br />

Construction in progress is stated at cost and not depreciated until such time that the assets are put<br />

into operational use.<br />

Intangible Assets<br />

Intangible assets acquired separately are measured on initial recognition at cost. Following initial<br />

recognition, intangible assets are carried at cost less accumulated amortization and accumulated<br />

impairment loss, if any. Internally-generated intangible assets, if any, excluding capitalized<br />

development costs, are not capitalized and expenditure is reflected in the consolidated statement of<br />

income in which the expenditure is incurred.<br />

165