EDC 2014 SR (UPDATED)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

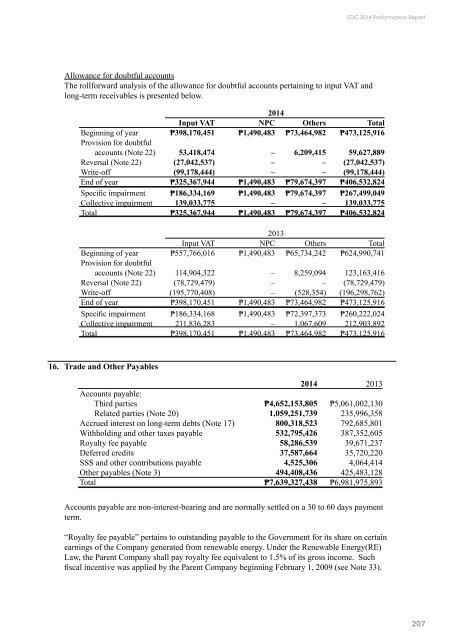

Allowance for doubtful accounts<br />

The rollforward analysis of the allowance for doubtful accounts pertaining to input VAT and<br />

long-term receivables is presented below.<br />

<strong>2014</strong><br />

Input VAT NPC Others Total<br />

Beginning of year ₱398,170,451 ₱1,490,483 ₱73,464,982 ₱473,125,916<br />

Provision for doubtful<br />

accounts (Note 22) 53,418,474 – 6,209,415 59,627,889<br />

Reversal (Note 22) (27,042,537) – – (27,042,537)<br />

Write-off (99,178,444) – – (99,178,444)<br />

End of year ₱325,367,944 ₱1,490,483 ₱79,674,397 ₱406,532,824<br />

Specific impairment ₱186,334,169 ₱1,490,483 ₱79,674,397 ₱267,499,049<br />

Collective impairment 139,033,775 – – 139,033,775<br />

Total ₱325,367,944 ₱1,490,483 ₱79,674,397 ₱406,532,824<br />

2013<br />

Input VAT NPC Others Total<br />

Beginning of year ₱557,766,016 ₱1,490,483 ₱65,734,242 ₱624,990,741<br />

Provision for doubtful<br />

accounts (Note 22) 114,904,322 – 8,259,094 123,163,416<br />

Reversal (Note 22) (78,729,479) – – (78,729,479)<br />

Write-off (195,770,408) – (528,354) (196,298,762)<br />

End of year ₱398,170,451 ₱1,490,483 ₱73,464,982 ₱473,125,916<br />

Specific impairment ₱186,334,168 ₱1,490,483 ₱72,397,373 ₱260,222,024<br />

Collective impairment 211,836,283 – 1,067,609 212,903,892<br />

Total ₱398,170,451 ₱1,490,483 ₱73,464,982 ₱473,125,916<br />

16.<br />

Trade and Other Payables<br />

<strong>2014</strong> 2013<br />

Accounts payable:<br />

Third parties ₱4,652,153,805 ₱5,061,002,130<br />

Related parties (Note 20) 1,059,251,739 235,996,358<br />

Accrued interest on long-term debts (Note 17) 800,318,523 792,685,801<br />

Withholding and other taxes payable 532,795,426 387,352,605<br />

Royalty fee payable 58,286,539 39,671,237<br />

Deferred credits 37,587,664 35,720,220<br />

SSS and other contributions payable 4,525,306 4,064,414<br />

Other payables (Note 3) 494,408,436 425,483,128<br />

Total ₱7,639,327,438 ₱6,981,975,893<br />

Accounts payable are non-interest-bearing and are normally settled on a 30 to 60 days payment<br />

term.<br />

“Royalty fee payable” pertains to outstanding payable to the Government for its share on certain<br />

earnings of the Company generated from renewable energy. Under the Renewable Energy(RE)<br />

Law, the Parent Company shall pay royalty fee equivalent to 1.5% of its gross income. Such<br />

fiscal incentive was applied by the Parent Company beginning February 1, 2009 (see Note 33).<br />

207