EDC 2014 SR (UPDATED)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

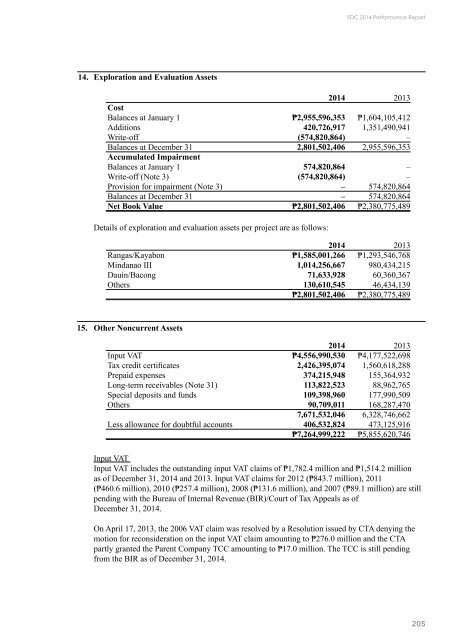

14.<br />

Exploration and Evaluation Assets<br />

<strong>2014</strong> 2013<br />

Cost<br />

Balances at January 1 ₱2,955,596,353 ₱1,604,105,412<br />

Additions 420,726,917 1,351,490,941<br />

Write-off (574,820,864) –<br />

Balances at December 31 2,801,502,406 2,955,596,353<br />

Accumulated Impairment<br />

Balances at January 1 574,820,864 –<br />

Write-off (Note 3) (574,820,864) –<br />

Provision for impairment (Note 3) – 574,820,864<br />

Balances at December 31 – 574,820,864<br />

Net Book Value ₱2,801,502,406 ₱2,380,775,489<br />

Details of exploration and evaluation assets per project are as follows:<br />

<strong>2014</strong> 2013<br />

Rangas/Kayabon ₱1,585,001,266 ₱1,293,546,768<br />

Mindanao III 1,014,256,667 980,434,215<br />

Dauin/Bacong 71,633,928 60,360,367<br />

Others 130,610,545 46,434,139<br />

₱2,801,502,406 ₱2,380,775,489<br />

15.<br />

Other Noncurrent Assets<br />

<strong>2014</strong> 2013<br />

Input VAT ₱4,556,990,530 ₱4,177,522,698<br />

Tax credit certificates 2,426,395,074 1,560,618,288<br />

Prepaid expenses 374,215,948 155,364,932<br />

Long-term receivables (Note 31) 113,822,523 88,962,765<br />

Special deposits and funds 109,398,960 177,990,509<br />

Others 90,709,011 168,287,470<br />

7,671,532,046 6,328,746,662<br />

Less allowance for doubtful accounts 406,532,824 473,125,916<br />

₱7,264,999,222 ₱5,855,620,746<br />

Input VAT<br />

Input VAT includes the outstanding input VAT claims of ₱1,782.4 million and ₱1,514.2 million<br />

as of December 31, <strong>2014</strong> and 2013. Input VAT claims for 2012 (₱843.7 million), 2011<br />

(₱460.6 million), 2010 (₱257.4 million), 2008 (₱131.6 million), and 2007 (₱89.1 million) are still<br />

pending with the Bureau of Internal Revenue (BIR)/Court of Tax Appeals as of<br />

December 31, <strong>2014</strong>.<br />

On April 17, 2013, the 2006 VAT claim was resolved by a Resolution issued by CTA denying the<br />

motion for reconsideration on the input VAT claim amounting to ₱276.0 million and the CTA<br />

partly granted the Parent Company TCC amounting to ₱17.0 million. The TCC is still pending<br />

from the BIR as of December 31, <strong>2014</strong>.<br />

205