EDC 2014 SR (UPDATED)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

Japanese<br />

yen (JP¥)<br />

Sweden<br />

kroner<br />

(SEK<br />

Original Currency<br />

Chilean<br />

Peso<br />

(CH₱)<br />

Peruvian<br />

Sol<br />

(PEN)<br />

<strong>2014</strong><br />

Singapore<br />

Dollar (SGD)<br />

New Zealand<br />

dollar (NZD)<br />

Peso<br />

Equivalent1<br />

US$<br />

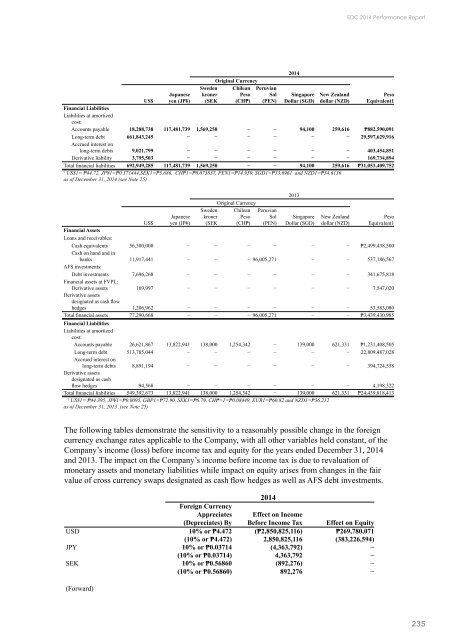

Financial Liabilities<br />

Liabilities at amortized<br />

cost:<br />

Accounts payable 18,288,738 117,481,739 1,569,250 − − 94,100 259,616 ₱882,590,091<br />

Long-term debt 661,843,245 − − − − − − 29,597,629,916<br />

Accrued interest on<br />

long-term debts 9,021,799 − − − − − − 403,454,851<br />

Derivative liability 3,795,503 − − − − − − 169,734,894<br />

Total financial liabilities 692,949,285 117,481,739 1,569,250 − − 94,100 259,616 ₱31,053,409,752<br />

1<br />

US$1= ₱44.72, JP¥1=₱0.371444,SEK1=₱5.686, CH₱1=₱0.073837, PEN1=₱14.959, SGD1=₱33.6961 and NZD1=₱34.6136<br />

as of December 31, <strong>2014</strong> (see Note 25)<br />

Japanese<br />

yen (JP¥)<br />

Sweden<br />

kroner<br />

(SEK<br />

Original Currency<br />

Chilean<br />

Peso<br />

(CH₱)<br />

Peruvian<br />

Sol<br />

(PEN)<br />

2013<br />

Singapore<br />

Dollar (SGD)<br />

New Zealand<br />

dollar (NZD)<br />

Peso<br />

Equivalent1<br />

US$<br />

Financial Assets<br />

Loans and receivables:<br />

Cash equivalents 56,300,000 − − − − − − ₱2,499,438,500<br />

Cash on hand and in<br />

banks 11,917,441 − − − 96,005,271 − − 537,186,567<br />

AFS investments:<br />

Debt investments 7,696,268 − − − − − − 341,675,818<br />

Financial assets at FVPL:<br />

Derivative assets 169,997 − − − − − − 7,547,020<br />

Derivative assets<br />

designated as cash flow<br />

hedges 1,206,962 − − − − − − 53,583,080<br />

Total financial assets 77,290,668 − − − 96,005,271 − − ₱3,439,430,985<br />

Financial Liabilities<br />

Liabilities at amortized<br />

cost:<br />

Accounts payable 26,621,867 13,822,941 138,000 1,254,342 − 139,000 621,331 ₱1,231,408,505<br />

Long-term debt 513,785,044 − − − − − − 22,809,487,028<br />

Accrued interest on<br />

long-term debts 8,891,194 − − − − − − 394,724,558<br />

Derivative assets<br />

designated as cash<br />

flow hedges 94,568 − − − − − − 4,198,322<br />

Total financial liabilities 549,392,673 13,822,941 138,000 1,254,342 − 139,000 621,331 ₱24,439,818,413<br />

1<br />

US$1= ₱44.395, JP¥1=₱0.0095, GBP1=₱72.90, SEK1=₱6.79, CH₱=1=₱0.08449, EUR1=₱60.82 and NZD1=₱36.212<br />

as of December 31, 2013 .(see Note 25)<br />

The following tables demonstrate the sensitivity to a reasonably possible change in the foreign<br />

currency exchange rates applicable to the Company, with all other variables held constant, of the<br />

Company’s income (loss) before income tax and equity for the years ended December 31, <strong>2014</strong><br />

and 2013. The impact on the Company’s income before income tax is due to revaluation of<br />

monetary assets and monetary liabilities while impact on equity arises from changes in the fair<br />

value of cross currency swaps designated as cash flow hedges as well as AFS debt investments.<br />

<strong>2014</strong><br />

Foreign Currency<br />

Appreciates<br />

(Depreciates) By<br />

Effect on Income<br />

Before Income Tax Effect on Equity<br />

USD 10% or ₱4.472 (₱2,850,825,116) ₱269,780,071<br />

(10% or ₱4.472) 2,850,825,116 (383,226,594)<br />

JPY 10% or ₱0.03714 (4,363,792) −<br />

(10% or ₱0.03714) 4,363,792 −<br />

SEK 10% or ₱0.56860 (892,276) −<br />

(10% or ₱0.56860) 892,276 −<br />

(Forward)<br />

235