EDC 2014 SR (UPDATED)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

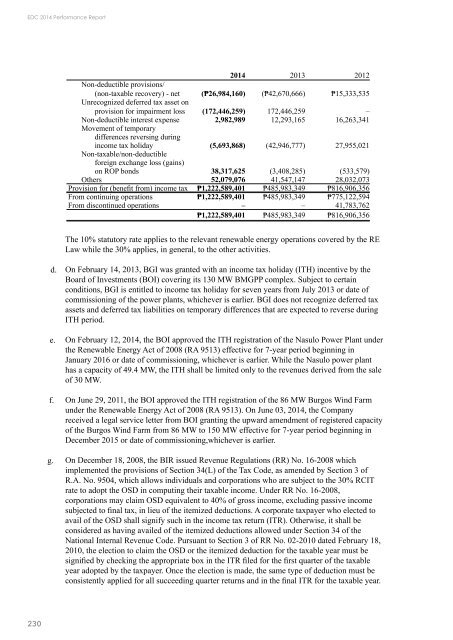

<strong>2014</strong> 2013 2012<br />

Non-deductible provisions/<br />

(non-taxable recovery) - net (₱26,984,160) (₱42,670,666) ₱15,333,535<br />

Unrecognized deferred tax asset on<br />

provision for impairment loss (172,446,259) 172,446,259 –<br />

Non-deductible interest expense 2,982,989 12,293,165 16,263,341<br />

Movement of temporary<br />

differences reversing during<br />

income tax holiday (5,693,868) (42,946,777) 27,955,021<br />

Non-taxable/non-deductible<br />

foreign exchange loss (gains)<br />

on ROP bonds 38,317,625 (3,408,285) (533,579)<br />

Others 52,079,076 41,547,147 28,032,073<br />

Provision for (benefit from) income tax ₱1,222,589,401 ₱485,983,349 ₱816,906,356<br />

From continuing operations ₱1,222,589,401 ₱485,983,349 ₱775,122,594<br />

From discontinued operations – – 41,783,762<br />

₱1,222,589,401 ₱485,983,349 ₱816,906,356<br />

The 10% statutory rate applies to the relevant renewable energy operations covered by the RE<br />

Law while the 30% applies, in general, to the other activities.<br />

d.<br />

e.<br />

f.<br />

g.<br />

On February 14, 2013, BGI was granted with an income tax holiday (ITH) incentive by the<br />

Board of Investments (BOI) covering its 130 MW BMGPP complex. Subject to certain<br />

conditions, BGI is entitled to income tax holiday for seven years from July 2013 or date of<br />

commissioning of the power plants, whichever is earlier. BGI does not recognize deferred tax<br />

assets and deferred tax liabilities on temporary differences that are expected to reverse during<br />

ITH period.<br />

On February 12, <strong>2014</strong>, the BOI approved the ITH registration of the Nasulo Power Plant under<br />

the Renewable Energy Act of 2008 (RA 9513) effective for 7-year period beginning in<br />

January 2016 or date of commissioning, whichever is earlier. While the Nasulo power plant<br />

has a capacity of 49.4 MW, the ITH shall be limited only to the revenues derived from the sale<br />

of 30 MW.<br />

On June 29, 2011, the BOI approved the ITH registration of the 86 MW Burgos Wind Farm<br />

under the Renewable Energy Act of 2008 (RA 9513). On June 03, <strong>2014</strong>, the Company<br />

received a legal service letter from BOI granting the upward amendment of registered capacity<br />

of the Burgos Wind Farm from 86 MW to 150 MW effective for 7-year period beginning in<br />

December 2015 or date of commissioning,whichever is earlier.<br />

On December 18, 2008, the BIR issued Revenue Regulations (RR) No. 16-2008 which<br />

implemented the provisions of Section 34(L) of the Tax Code, as amended by Section 3 of<br />

R.A. No. 9504, which allows individuals and corporations who are subject to the 30% RCIT<br />

rate to adopt the OSD in computing their taxable income. Under RR No. 16-2008,<br />

corporations may claim OSD equivalent to 40% of gross income, excluding passive income<br />

subjected to final tax, in lieu of the itemized deductions. A corporate taxpayer who elected to<br />

avail of the OSD shall signify such in the income tax return (ITR). Otherwise, it shall be<br />

considered as having availed of the itemized deductions allowed under Section 34 of the<br />

National Internal Revenue Code. Pursuant to Section 3 of RR No. 02-2010 dated February 18,<br />

2010, the election to claim the OSD or the itemized deduction for the taxable year must be<br />

signified by checking the appropriate box in the ITR filed for the first quarter of the taxable<br />

year adopted by the taxpayer. Once the election is made, the same type of deduction must be<br />

consistently applied for all succeeding quarter returns and in the final ITR for the taxable year.<br />

230