EDC 2014 SR (UPDATED)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

On May 8, 2012, upon execution of their respective Geothermal Operating Contracts with the<br />

DOE, GCGI and BGI also became subject to royalty fee of 1.5% of their gross income<br />

(see Note 33).<br />

In <strong>2014</strong>, upon receipt of COE for fit eligibility EBWPC became subject to royalty fee of 1% of its<br />

gross income.<br />

Royalty fees are allocated between the DOE and LGUs where the geothermal resources are<br />

located and payable within 60 days after the end of each quarter. Royalty fee expense amounted<br />

to ₱269.1 million, ₱230.8 million and ₱169.8 million for the years ended December 31, <strong>2014</strong>,<br />

2013 and 2012, respectively (see Note 21).<br />

“Other payables” account includes mainly provision for shortfall generation and portion of<br />

liabilities on regulatory assessments and other contingencies (see Note 3).<br />

As of December 31, <strong>2014</strong> and 2013, the Company has ₱19.0 billion and ₱15.3 billion, respectively,<br />

of unused credit facilities from various local banks, which may be availed of for future operating<br />

activities.<br />

17.<br />

Long-term Debts<br />

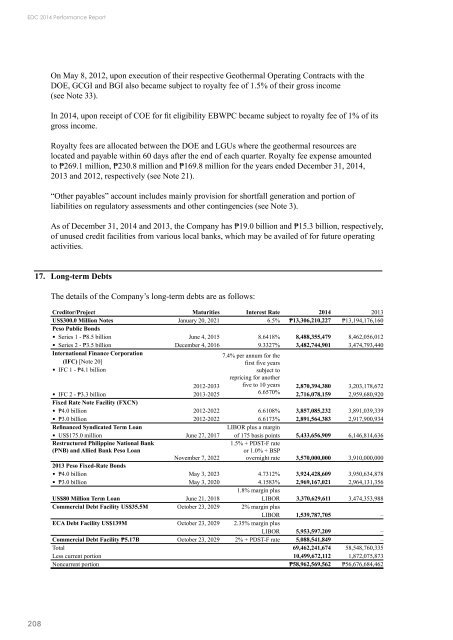

The details of the Company’s long-term debts are as follows:<br />

Creditor/Project Maturities Interest Rate <strong>2014</strong> 2013<br />

US$300.0 Million Notes January 20, 2021 6.5% ₱13,306,210,227 ₱13,194,176,160<br />

Peso Public Bonds<br />

Series 1 - ₱8.5 billion June 4, 2015 8.6418% 8,488,355,479 8,462,056,012<br />

Series 2 - ₱3.5 billion December 4, 2016 9.3327% 3,482,744,901 3,474,793,440<br />

International Finance Corporation<br />

(IFC) [Note 20]<br />

IFC 1 - ₱4.1 billion<br />

7.4% per annum for the<br />

first five years<br />

subject to<br />

repricing for another<br />

five to 10 years<br />

2012-2033 2,870,394,380 3,203,178,672<br />

IFC 2 - ₱3.3 billion 2013-2025 6.6570% 2,716,078,159 2,959,680,920<br />

Fixed Rate Note Facility (FXCN)<br />

₱4.0 billion 2012-2022 6.6108% 3,857,085,232 3,891,039,339<br />

₱3.0 billion 2012-2022 6.6173% 2,891,564,383 2,917,900,934<br />

Refinanced Syndicated Term Loan<br />

LIBOR plus a margin<br />

US$175.0 million June 27, 2017 of 175 basis points 5,433,656,909 6,146,814,636<br />

Restructured Philippine National Bank<br />

(PNB) and Allied Bank Peso Loan<br />

November 7, 2022<br />

1.5% + PDST-F rate<br />

or 1.0% + BSP<br />

overnight rate 3,570,000,000 3,910,000,000<br />

2013 Peso Fixed-Rate Bonds<br />

₱4.0 billion May 3, 2023 4.7312% 3,924,428,609 3,950,634,878<br />

₱3.0 billion May 3, 2020 4.1583% 2,969,167,021 2,964,131,356<br />

1.8% margin plus<br />

US$80 Million Term Loan June 21, 2018 LIBOR 3,370,629,611 3,474,353,988<br />

Commercial Debt Facility US$35.5M October 23, 2029 2% margin plus<br />

LIBOR 1,539,787,705 –<br />

ECA Debt Facility US$139M October 23, 2029 2.35% margin plus<br />

LIBOR 5,953,597,209 –<br />

Commercial Debt Facility ₱5.17B October 23, 2029 2% + PDST-F rate 5,088,541,849 –<br />

Total 69,462,241,674 58,548,760,335<br />

Less current portion 10,499,672,112 1,872,075,873<br />

Noncurrent portion ₱58,962,569,562 ₱56,676,684,462<br />

208