EDC 2014 SR (UPDATED)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

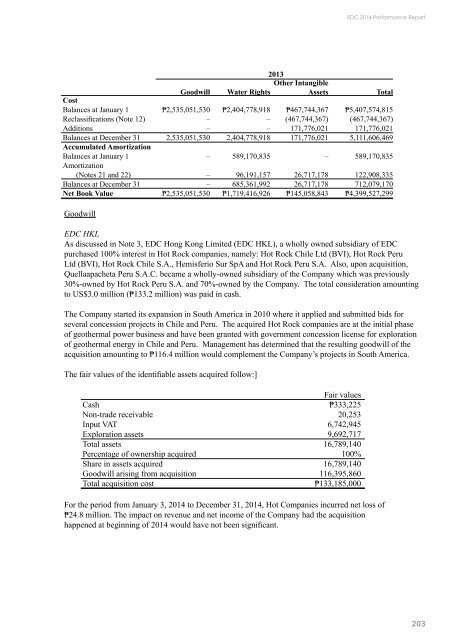

2013<br />

Other Intangible<br />

Goodwill Water Rights Assets<br />

Total<br />

Cost<br />

Balances at January 1 ₱2,535,051,530 ₱2,404,778,918 ₱467,744,367 ₱5,407,574,815<br />

Reclassifications (Note 12) – – (467,744,367) (467,744,367)<br />

Additions – – 171,776,021 171,776,021<br />

Balances at December 31 2,535,051,530 2,404,778,918 171,776,021 5,111,606,469<br />

Accumulated Amortization<br />

Balances at January 1 – 589,170,835 – 589,170,835<br />

Amortization<br />

(Notes 21 and 22) – 96,191,157 26,717,178 122,908,335<br />

Balances at December 31 – 685,361,992 26,717,178 712,079,170<br />

Net Book Value ₱2,535,051,530 ₱1,719,416,926 ₱145,058,843 ₱4,399,527,299<br />

Goodwill<br />

<strong>EDC</strong> HKL<br />

As discussed in Note 3, <strong>EDC</strong> Hong Kong Limited (<strong>EDC</strong> HKL), a wholly owned subsidiary of <strong>EDC</strong><br />

purchased 100% interest in Hot Rock companies, namely: Hot Rock Chile Ltd (BVI), Hot Rock Peru<br />

Ltd (BVI), Hot Rock Chile S.A., Hemisferio Sur SpA and Hot Rock Peru S.A. Also, upon acquisition,<br />

Quellaapacheta Peru S.A.C. became a wholly-owned subsidiary of the Company which was previously<br />

30%-owned by Hot Rock Peru S.A. and 70%-owned by the Company. The total consideration amounting<br />

to US$3.0 million (₱133.2 million) was paid in cash.<br />

The Company started its expansion in South America in 2010 where it applied and submitted bids for<br />

several concession projects in Chile and Peru. The acquired Hot Rock companies are at the initial phase<br />

of geothermal power business and have been granted with government concession license for exploration<br />

of geothermal energy in Chile and Peru. Management has determined that the resulting goodwill of the<br />

acquisition amounting to ₱116.4 million would complement the Company’s projects in South America.<br />

The fair values of the identifiable assets acquired follow:]<br />

Fair values<br />

Cash ₱333,225<br />

Non-trade receivable 20,253<br />

Input VAT 6,742,945<br />

Exploration assets 9,692,717<br />

Total assets 16,789,140<br />

Percentage of ownership acquired 100%<br />

Share in assets acquired 16,789,140<br />

Goodwill arising from acquisition 116,395,860<br />

Total acquisition cost ₱133,185,000<br />

For the period from January 3, <strong>2014</strong> to December 31, <strong>2014</strong>, Hot Companies incurred net loss of<br />

₱24.8 million. The impact on revenue and net income of the Company had the acquisition<br />

happened at beginning of <strong>2014</strong> would have not been significant.<br />

203