EDC 2014 SR (UPDATED)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EDC</strong> <strong>2014</strong> Performance Report<br />

9.<br />

Available-for-sale Investments/Financial Asset at Fair Value Through Profit or Loss<br />

Financial asset at fair value through profit or loss<br />

In January <strong>2014</strong>, the Company entered into an investment management agreement (IMA) whereby<br />

the Company availed of the services of Security Bank relative to the management and investment<br />

of funds amounting to ₱500.0 million.<br />

Among others, following are the significant provisions of the IMA:<br />

The Investment Manager shall administer and manage the fund as allowed and subject to the<br />

requirements of the Central Bank of the Philippines and in accordance with the written investment<br />

policy and guidelines mutually agreed upon and signed by Security Bank and the Company.<br />

The agreement is considered as an agency and not a trust agreement. The Company, therefore,<br />

shall at all times retain legal title to the fund.<br />

The IMA does not guaranty a yield, return, or income on the investments or reinvestments made<br />

by the Investment Manager. Any loss or depreciation in the value of the assets of the fund shall be<br />

for the account of the Company.<br />

The Company accounts for the entire investment as a financial asset to be carried at fair value<br />

through profit or loss. Mark-to-market adjustment on the securities is taken up in the consolidated<br />

income statement amounted to ₱23.6 million in <strong>2014</strong>.<br />

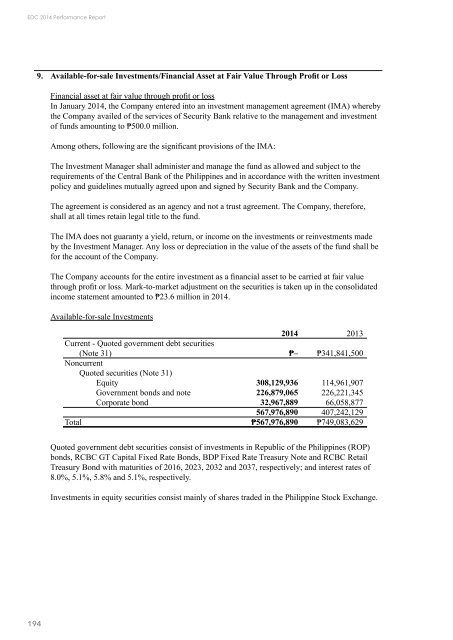

Available-for-sale Investments<br />

<strong>2014</strong> 2013<br />

Current - Quoted government debt securities<br />

(Note 31) ₱– ₱341,841,500<br />

Noncurrent<br />

Quoted securities (Note 31)<br />

Equity 308,129,936 114,961,907<br />

Government bonds and note 226,879,065 226,221,345<br />

Corporate bond 32,967,889 66,058,877<br />

567,976,890 407,242,129<br />

Total ₱567,976,890 ₱749,083,629<br />

Quoted government debt securities consist of investments in Republic of the Philippines (ROP)<br />

bonds, RCBC GT Capital Fixed Rate Bonds, BDP Fixed Rate Treasury Note and RCBC Retail<br />

Treasury Bond with maturities of 2016, 2023, 2032 and 2037, respectively; and interest rates of<br />

8.0%, 5.1%, 5.8% and 5.1%, respectively.<br />

Investments in equity securities consist mainly of shares traded in the Philippine Stock Exchange.<br />

194