MIPIM 2019 (24.1 MB)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Investing in Austria<br />

Trend 2<br />

THE BIG NAMES ARE MISSING<br />

According to a recent annual survey conducted<br />

by RegioData Research on more<br />

than 800 chain stores and franchise<br />

systems, approx. 460 Austrian retail and<br />

commercial companies are planning to<br />

expand this year. This figure is about 15%<br />

down from the previous year and about<br />

40% less than 5 years ago. A few years<br />

ago the big chain stores trading in clothes,<br />

shoes, furniture, etc. were looking for new<br />

locations. In the meantime this role has<br />

been taken over by smaller companies.<br />

Food retailers represent the exception – in<br />

this sector expansion remains vigorous.<br />

Trend 3<br />

SUPPLY OF SPACE<br />

EXCEEDS DEMAND<br />

If one balances the expansion requirements<br />

for <strong>2019</strong> against the anticipated<br />

branch closures, then this year (for the<br />

first time in ten years) will see more abandoned<br />

sites than new openings for retail<br />

and commercial services (system gastronomy,<br />

banks, travel agencies, hairdressers,<br />

etc.). A decade ago, this was down to<br />

the impact of the economic crisis - now<br />

it is online trading that leads to closures.<br />

Consequently, this trend does not apply<br />

to sectors that are not or little affected by<br />

online retailing: food retailers, chemists<br />

and system gastronomy.<br />

Trend 4<br />

THE HIGH-FLYING SECTOR:<br />

SYSTEM GASTRONOMY<br />

The system gastronomy sector is seeking<br />

the majority of sites. Since both Austrians<br />

and tourists are spending more and more<br />

money on eating out year upon year, the<br />

potential as well as the possibility of expansion<br />

strongly increase. But even here<br />

it's no longer only the big players, but many<br />

new, small companies that are testing<br />

their fortunes with innovative concepts. A<br />

total of 76 different gastronomic concepts<br />

are looking for new locations this year.<br />

sult, prime rents in the city center were able to<br />

maintain their high level, while investors in virtually<br />

all other locations had to accept price<br />

reductions for new and subsequent-rental<br />

properties recently. With a stable 400 Euros<br />

per square meter in the luxury locations in<br />

the first district, Vienna remained one of the<br />

ten most expensive high-street locations in<br />

the world in 2018.<br />

Bitzer expects the trend of retail space in large<br />

shopping centers to be partially replaced by<br />

gastronomy, entertainment and services to<br />

increase. "One used to assume that a shopping<br />

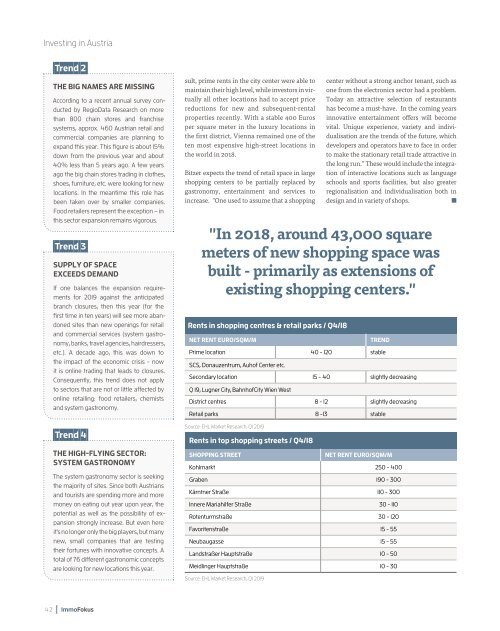

Rents in shopping centres & retail parks / Q4/18<br />

NET RENT EURO/SQM/M<br />

TREND<br />

Prime location 40 - 120 stable<br />

SCS, Donauzentrum, Auhof Center etc.<br />

Secondary location 15 - 40 slightly decreasing<br />

Q 19, Lugner City, BahnhofCity Wien West<br />

District centres 8 - 12 slightly decreasing<br />

Retail parks 8 -13 stable<br />

Source: EHL Market Research, Q1 <strong>2019</strong><br />

Rents in top shopping streets / Q4/18<br />

SHOPPING STREET<br />

NET RENT EURO/SQM/M<br />

Kohlmarkt 250 - 400<br />

Graben 190 - 300<br />

Kärntner Straße 110 - 300<br />

Innere Mariahilfer Straße 30 - 110<br />

Rotenturmstraße 30 - 120<br />

Favoritenstraße 15 - 55<br />

Neubaugasse 15 - 55<br />

Landstraßer Hauptstraße 10 - 50<br />

Meidlinger Hauptstraße 10 - 30<br />

Source: EHL Market Research, Q1 <strong>2019</strong><br />

center without a strong anchor tenant, such as<br />

one from the electronics sector had a problem.<br />

Today an attractive selection of restaurants<br />

has become a must-have. In the coming years<br />

innovative entertainment offers will become<br />

vital. Unique experience, variety and individualisation<br />

are the trends of the future, which<br />

developers and operators have to face in order<br />

to make the stationary retail trade attractive in<br />

the long run.” These would include the integration<br />

of interactive locations such as language<br />

schools and sports facilities, but also greater<br />

regionalisation and individualisation both in<br />

design and in variety of shops.<br />

n<br />

"In 2018, around 43,000 square<br />

meters of new shopping space was<br />

built - primarily as extensions of<br />

existing shopping centers."<br />

42 ImmoFokus