The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s discussion and analysis of financial condition<br />

and results of operations<br />

Results of Operations<br />

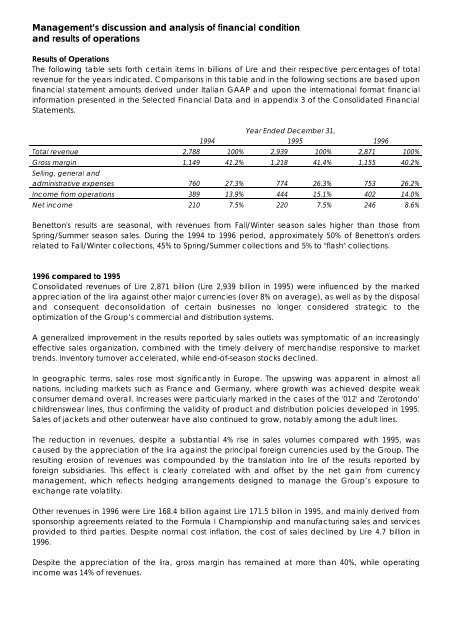

<strong>The</strong> following table sets forth certain items in billions of Lire and their respective percentages of total<br />

revenue for the years indicated. Comparisons in this table and in the following sections are based upon<br />

financial statement amounts derived under Italian GAAP and upon the international format financial<br />

information presented in the Selected Financial Data and in appendix 3 of the Consolidated Financial<br />

Statements.<br />

Year Ended December 31,<br />

1994 1995 <strong>1996</strong><br />

Total revenue 2,788 100% 2,939 100% 2,871 100%<br />

Gross margin 1,149 41.2% 1,218 41.4% 1,155 40.2%<br />

Selling, general and<br />

administrative expenses 760 27.3% 774 26.3% 753 26.2%<br />

Income from operations 389 13.9% 444 15.1% 402 14.0%<br />

Net income 210 7.5% 220 7.5% 246 8.6%<br />

<strong>Benetton</strong>'s results are seasonal, with revenues from Fall/Winter season sales higher than those from<br />

Spring/Summer season sales. During the 1994 to <strong>1996</strong> period, approximately 50% of <strong>Benetton</strong>'s orders<br />

related to Fall/Winter collections, 45% to Spring/Summer collections and 5% to "flash" collections.<br />

<strong>1996</strong> compared to 1995<br />

Consolidated revenues of Lire 2,871 billion (Lire 2,939 billion in 1995) were influenced by the marked<br />

appreciation of the lira against other major currencies (over 8% on average), as well as by the disposal<br />

and consequent deconsolidation of certain businesses no longer considered strategic to the<br />

optimization of the <strong>Group</strong>’s commercial and distribution systems.<br />

A generalized improvement in the results reported by sales outlets was symptomatic of an increasingly<br />

effective sales organization, combined with the timely delivery of merchandise responsive to market<br />

trends. Inventory turnover accelerated, while end-of-season stocks declined.<br />

In geographic terms, sales rose most significantly in Europe. <strong>The</strong> upswing was apparent in almost all<br />

nations, including markets such as France and Germany, where growth was achieved despite weak<br />

consumer demand overall. Increases were particularly marked in the cases of the '012' and 'Zerotondo'<br />

childrenswear lines, thus confirming the validity of product and distribution policies developed in 1995.<br />

Sales of jackets and other outerwear have also continued to grow, notably among the adult lines.<br />

<strong>The</strong> reduction in revenues, despite a substantial 4% rise in sales volumes compared with 1995, was<br />

caused by the appreciation of the lira against the principal foreign currencies used by the <strong>Group</strong>. <strong>The</strong><br />

resulting erosion of revenues was compounded by the translation into lire of the results reported by<br />

foreign subsidiaries. This effect is clearly correlated with and offset by the net gain from currency<br />

management, which reflects hedging arrangements designed to manage the <strong>Group</strong>’s exposure to<br />

exchange rate volatility.<br />

Other revenues in <strong>1996</strong> were Lire 168.4 billion against Lire 171.5 billion in 1995, and mainly derived from<br />

sponsorship agreements related to the Formula I Championship and manufacturing sales and services<br />

provided to third parties. Despite normal cost inflation, the cost of sales declined by Lire 4.7 billion in<br />

<strong>1996</strong>.<br />

Despite the appreciation of the lira, gross margin has remained at more than 40%, while operating<br />

income was 14% of revenues.