The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4. Accounting policies<br />

<strong>The</strong> accounting policies adopted in the preparation of the consolidated financial statements are<br />

consistent with those applied by the Parent Company, as summarized below:<br />

Intangible fixed assets<br />

<strong>The</strong>se are recorded at purchase cost, including related charges.<br />

Trademarks are stated at registration or purchase cost, as revalued as of December 31, 1983, in<br />

accordance with the provisions of Law 72 of March 19, 1983. <strong>The</strong> related revaluation surplus was<br />

credited to a specific stockholders' equity reserve. <strong>The</strong> amount is stated net of accumulated<br />

amortization, which is generally provided over twenty years.<br />

Intangible fixed assets are written down in cases where, regardless of the amortization accumulated,<br />

there is a permanent loss in value. <strong>The</strong> value of such assets is reinstated in future accounting periods<br />

should the reasons for such writedowns no longer apply.<br />

Costs deferred in connection with expansion projects and other deferred charges are amortized on a<br />

straight-line basis over the period they are expected to benefit, which is generally five years. Patents are<br />

amortized over three years.<br />

Goodwill and consolidation differences are amortized over ten years.<br />

Tangible fixed assets<br />

<strong>The</strong>se are recorded at purchase or construction cost, as adjusted in certain circumstances through the<br />

application of specific monetary revaluation laws. Cost includes related charges and direct or indirect<br />

expenses reasonably attributable to the individual assets. Tangible fixed assets transferred within the<br />

<strong>Group</strong> as of December 31, 1980, were recorded at appraised values.<br />

<strong>The</strong> principal Italian <strong>Group</strong> companies restated the majority of their assets as of December 31, 1983 in a<br />

monetary revaluation in accordance with the provisions of Law 72 of March 19, 1983. <strong>The</strong>se companies<br />

were also obliged by Law 413 of December 30, 1991 to revalue their real estate holdings.<br />

In <strong>1996</strong>, a Spanish subsidiary restated its tangible fixed assets by Lire 1,210 million in a monetary<br />

revaluation in accordance with local legislation (Royal Decree 2607/96).<br />

Depreciation is computed on a straight-line basis using rates considered to reflect the estimated useful<br />

lives of tangible fixed assets. Half the annual depreciation rates are charged in the year the assets enter<br />

service.<br />

Tangible fixed assets are written down in cases where, regardless of the depreciation accumulated,<br />

there is a permanent loss in value. <strong>The</strong> value of such assets is reinstated in future accounting periods<br />

should the reasons for such writedowns no longer apply.<br />

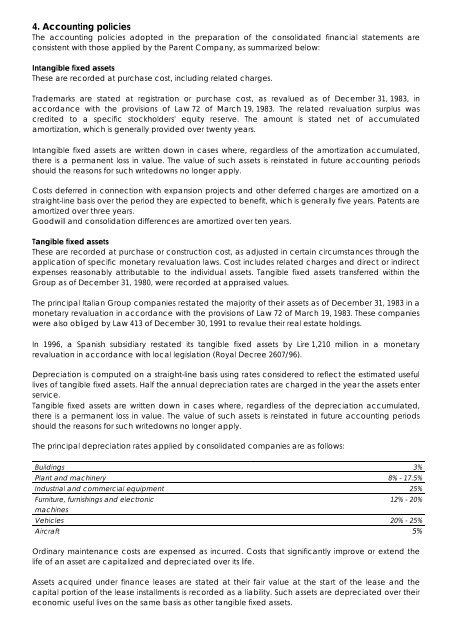

<strong>The</strong> principal depreciation rates applied by consolidated companies are as follows:<br />

Buildings 3%<br />

Plant and machinery 8% - 17.5%<br />

Industrial and commercial equipment 25%<br />

Furniture, furnishings and electronic<br />

machines<br />

12% - 20%<br />

Vehicles 20% - 25%<br />

Aircraft 5%<br />

Ordinary maintenance costs are expensed as incurred. Costs that significantly improve or extend the<br />

life of an asset are capitalized and depreciated over its life.<br />

Assets acquired under finance leases are stated at their fair value at the start of the lease and the<br />

capital portion of the lease installments is recorded as a liability. Such assets are depreciated over their<br />

economic useful lives on the same basis as other tangible fixed assets.