The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

As discussed in note 3, other financial income includes approximately Lire 21,200 million (around<br />

Lire 24,100 million in 1995) of exchange gains on capital hedging transactions, representing the<br />

differentials between spot and forward exchange rates.<br />

This caption also includes:<br />

– positive differentials on interest rate swaps and forward rate agreements, approximately Lire 41,300<br />

million (approximately Lire 18,100 million in 1995);<br />

– premiums collected on options and income deriving from the adjustment of warrant-related<br />

transactions linked to the Lire 200,000 million bond issued by <strong>Benetton</strong> International N.V. (Note 22),<br />

approximately Lire 3,300 million (around Lire 8,400 million in 1995);<br />

– income from currency swaps, approximately Lire 4,700 million (around Lire 8,600 million in 1995).<br />

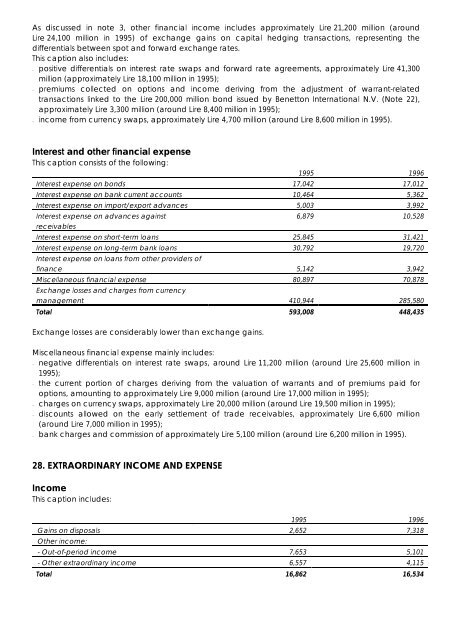

Interest and other financial expense<br />

This caption consists of the following:<br />

1995 <strong>1996</strong><br />

Interest expense on bonds 17,042 17,012<br />

Interest expense on bank current accounts 10,464 5,362<br />

Interest expense on import/export advances 5,003 3,992<br />

Interest expense on advances against<br />

receivables<br />

6,879 10,528<br />

Interest expense on short-term loans 25,845 31,421<br />

Interest expense on long-term bank loans 30,792 19,720<br />

Interest expense on loans from other providers of<br />

finance<br />

Miscellaneous financial expense 80,897 70,878<br />

Exchange losses and charges from currency<br />

management<br />

5,142<br />

410,944<br />

3,942<br />

285,580<br />

Total 593,008 448,435<br />

Exchange losses are considerably lower than exchange gains.<br />

Miscellaneous financial expense mainly includes:<br />

– negative differentials on interest rate swaps, around Lire 11,200 million (around Lire 25,600 million in<br />

1995);<br />

– the current portion of charges deriving from the valuation of warrants and of premiums paid for<br />

options, amounting to approximately Lire 9,000 million (around Lire 17,000 million in 1995);<br />

– charges on currency swaps, approximately Lire 20,000 million (around Lire 19,500 million in 1995);<br />

– discounts allowed on the early settlement of trade receivables, approximately Lire 6,600 million<br />

(around Lire 7,000 million in 1995);<br />

– bank charges and commission of approximately Lire 5,100 million (around Lire 6,200 million in 1995).<br />

28. EXTRAORDINARY INCOME AND EXPENSE<br />

Income<br />

This caption includes:<br />

1995 <strong>1996</strong><br />

Gains on disposals 2,652 7,318<br />

Other income:<br />

- Out-of-period income 7,653 5,101<br />

- Other extraordinary income 6,557 4,115<br />

Total 16,862 16,534