The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

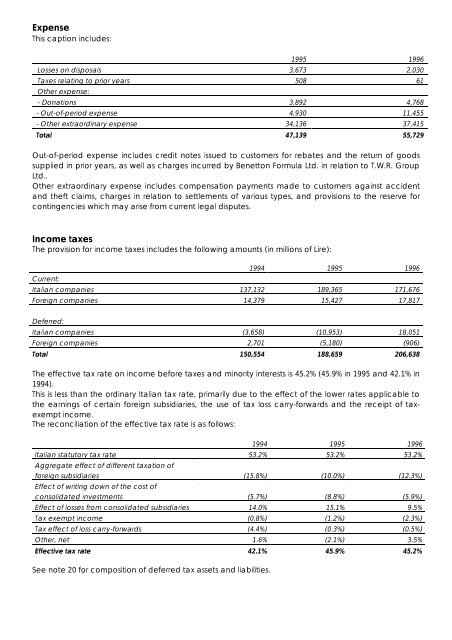

Expense<br />

This caption includes:<br />

1995 <strong>1996</strong><br />

Losses on disposals 3,673 2,030<br />

Taxes relating to prior years 508 61<br />

Other expense:<br />

- Donations 3,892 4,768<br />

- Out-of-period expense 4,930 11,455<br />

- Other extraordinary expense 34,136 37,415<br />

Total 47,139 55,729<br />

Out-of-period expense includes credit notes issued to customers for rebates and the return of goods<br />

supplied in prior years, as well as charges incurred by <strong>Benetton</strong> Formula Ltd. in relation to T.W.R. <strong>Group</strong><br />

Ltd..<br />

Other extraordinary expense includes compensation payments made to customers against accident<br />

and theft claims, charges in relation to settlements of various types, and provisions to the reserve for<br />

contingencies which may arise from current legal disputes.<br />

Income taxes<br />

<strong>The</strong> provision for income taxes includes the following amounts (in millions of Lire):<br />

Current:<br />

1994 1995 <strong>1996</strong><br />

Italian companies 137,132 189,365 171,676<br />

Foreign companies 14,379 15,427 17,817<br />

Deferred:<br />

Italian companies (3,658) (10,953) 18,051<br />

Foreign companies 2,701 (5,180) (906)<br />

Total 150,554 188,659 206,638<br />

<strong>The</strong> effective tax rate on income before taxes and minority interests is 45.2% (45.9% in 1995 and 42.1% in<br />

1994).<br />

This is less than the ordinary Italian tax rate, primarily due to the effect of the lower rates applicable to<br />

the earnings of certain foreign subsidiaries, the use of tax loss carry-forwards and the receipt of taxexempt<br />

income.<br />

<strong>The</strong> reconciliation of the effective tax rate is as follows:<br />

1994 1995 <strong>1996</strong><br />

Italian statutory tax rate 53.2% 53.2% 53.2%<br />

Aggregate effect of different taxation of<br />

foreign subsidiaries (15.8%) (10.0%) (12.3%)<br />

Effect of writing down of the cost of<br />

consolidated investments (5.7%) (8.8%) (5.9%)<br />

Effect of losses from consolidated subsidiaries 14.0% 15.1% 9.5%<br />

Tax exempt income (0.8%) (1.2%) (2.3%)<br />

Tax effect of loss carry-forwards (4.4%) (0.3%) (0.5%)<br />

Other, net 1.6% (2.1%) 3.5%<br />

Effective tax rate 42.1% 45.9% 45.2%<br />

See note 20 for composition of deferred tax assets and liabilities.