The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

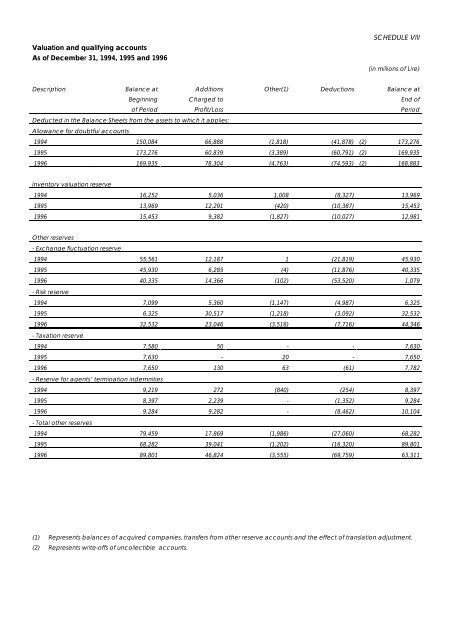

Valuation and qualifying accounts<br />

As of December 31, 1994, 1995 and <strong>1996</strong><br />

Description Balance at<br />

Beginning<br />

of Period<br />

Additions<br />

Charged to<br />

Profit/Loss<br />

Deducted in the Balance Sheets from the assets to which it applies:<br />

Allowance for doubtful accounts<br />

SCHEDULE VIII<br />

(in millions of Lire)<br />

Other(1) Deductions Balance at<br />

1994 150,084 66,888 (1,818) (41,878) (2) 173,276<br />

1995 173,276 60,839 (3,389) (60,791) (2) 169,935<br />

<strong>1996</strong> 169,935 78,304 (4,763) (74,593) (2) 168,883<br />

Inventory valuation reserve<br />

1994 16,252 5,036 1,008 (8,327) 13,969<br />

1995 13,969 12,291 (420) (10,387) 15,453<br />

<strong>1996</strong> 15,453 9,382 (1,827) (10,027) 12,981<br />

Other reserves<br />

- Exchange fluctuation reserve<br />

1994 55,561 12,187 1 (21,819) 45,930<br />

1995 45,930 6,285 (4) (11,876) 40,335<br />

<strong>1996</strong> 40,335 14,366 (102) (53,520) 1,079<br />

- Risk reserve<br />

1994 7,099 5,360 (1,147) (4,987) 6,325<br />

1995 6,325 30,517 (1,218) (3,092) 32,532<br />

<strong>1996</strong> 32,532 23,046 (3,516) (7,716) 44,346<br />

- Taxation reserve<br />

1994 7,580 50 - - 7,630<br />

1995 7,630 - 20 - 7,650<br />

<strong>1996</strong> 7,650 130 63 (61) 7,782<br />

- Reserve for agents’ termination indemnities<br />

1994 9,219 272 (840) (254) 8,397<br />

1995 8,397 2,239 - (1,352) 9,284<br />

<strong>1996</strong> 9,284 9,282 - (8,462) 10,104<br />

- Total other reserves<br />

1994 79,459 17,869 (1,986) (27,060) 68,282<br />

1995 68,282 39,041 (1,202) (16,320) 89,801<br />

<strong>1996</strong> 89,801 46,824 (3,555) (69,759) 63,311<br />

(1) Represents balances of acquired companies, transfers from other reserve accounts and the effect of translation adjustment.<br />

(2) Represents write-offs of uncollectible accounts.<br />

End of<br />

Period