The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

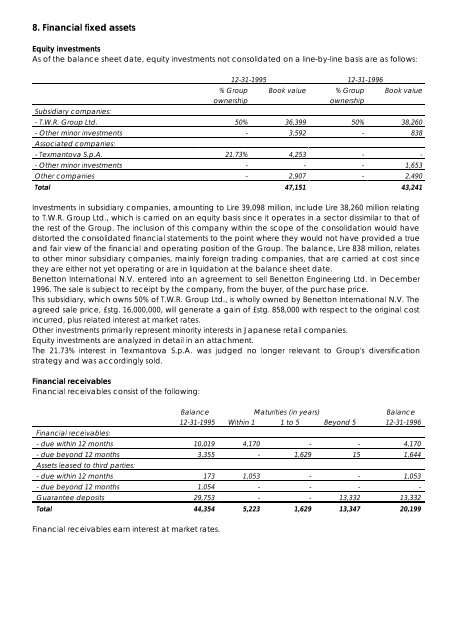

8. Financial fixed assets<br />

Equity investments<br />

As of the balance sheet date, equity investments not consolidated on a line-by-line basis are as follows:<br />

Subsidiary companies:<br />

12-31-1995 12-31-<strong>1996</strong><br />

% <strong>Group</strong><br />

ownership<br />

Book value % <strong>Group</strong><br />

ownership<br />

Book value<br />

- T.W.R. <strong>Group</strong> Ltd. 50% 36,399 50% 38,260<br />

- Other minor investments - 3,592 - 838<br />

Associated companies:<br />

- Texmantova S.p.A. 21.73% 4,253 - -<br />

- Other minor investments - - - 1,653<br />

Other companies - 2,907 - 2,490<br />

Total 47,151 43,241<br />

Investments in subsidiary companies, amounting to Lire 39,098 million, include Lire 38,260 million relating<br />

to T.W.R. <strong>Group</strong> Ltd., which is carried on an equity basis since it operates in a sector dissimilar to that of<br />

the rest of the <strong>Group</strong>. <strong>The</strong> inclusion of this company within the scope of the consolidation would have<br />

distorted the consolidated financial statements to the point where they would not have provided a true<br />

and fair view of the financial and operating position of the <strong>Group</strong>. <strong>The</strong> balance, Lire 838 million, relates<br />

to other minor subsidiary companies, mainly foreign trading companies, that are carried at cost since<br />

they are either not yet operating or are in liquidation at the balance sheet date.<br />

<strong>Benetton</strong> International N.V. entered into an agreement to sell <strong>Benetton</strong> Engineering Ltd. in December<br />

<strong>1996</strong>. <strong>The</strong> sale is subject to receipt by the company, from the buyer, of the purchase price.<br />

This subsidiary, which owns 50% of T.W.R. <strong>Group</strong> Ltd., is wholly owned by <strong>Benetton</strong> International N.V. <strong>The</strong><br />

agreed sale price, £stg. 16,000,000, will generate a gain of £stg. 858,000 with respect to the original cost<br />

incurred, plus related interest at market rates.<br />

Other investments primarily represent minority interests in Japanese retail companies.<br />

Equity investments are analyzed in detail in an attachment.<br />

<strong>The</strong> 21.73% interest in Texmantova S.p.A. was judged no longer relevant to <strong>Group</strong>'s diversification<br />

strategy and was accordingly sold.<br />

Financial receivables<br />

Financial receivables consist of the following:<br />

Financial receivables:<br />

Balance Maturities (in years) Balance<br />

12-31-1995 Within 1 1 to 5 Beyond 5 12-31-<strong>1996</strong><br />

- due within 12 months 10,019 4,170 - - 4,170<br />

- due beyond 12 months 3,355 - 1,629 15 1,644<br />

Assets leased to third parties:<br />

- due within 12 months 173 1,053 - - 1,053<br />

- due beyond 12 months 1,054 - - - -<br />

Guarantee deposits 29,753 - - 13,332 13,332<br />

Total 44,354 5,223 1,629 13,347 20,199<br />

Financial receivables earn interest at market rates.