The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

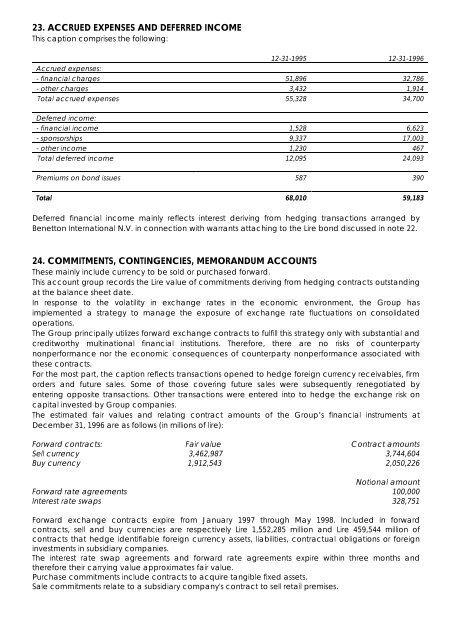

23. ACCRUED EXPENSES AND DEFERRED INCOME<br />

This caption comprises the following:<br />

12-31-1995 12-31-<strong>1996</strong><br />

Accrued expenses:<br />

- financial charges 51,896 32,786<br />

- other charges 3,432 1,914<br />

Total accrued expenses 55,328 34,700<br />

Deferred income:<br />

- financial income 1,528 6,623<br />

- sponsorships 9,337 17,003<br />

- other income 1,230 467<br />

Total deferred income 12,095 24,093<br />

Premiums on bond issues 587 390<br />

Total 68,010 59,183<br />

Deferred financial income mainly reflects interest deriving from hedging transactions arranged by<br />

<strong>Benetton</strong> International N.V. in connection with warrants attaching to the Lire bond discussed in note 22.<br />

24. COMMITMENTS, CONTINGENCIES, MEMORANDUM ACCOUNTS<br />

<strong>The</strong>se mainly include currency to be sold or purchased forward.<br />

This account group records the Lire value of commitments deriving from hedging contracts outstanding<br />

at the balance sheet date.<br />

In response to the volatility in exchange rates in the economic environment, the <strong>Group</strong> has<br />

implemented a strategy to manage the exposure of exchange rate fluctuations on consolidated<br />

operations.<br />

<strong>The</strong> <strong>Group</strong> principally utilizes forward exchange contracts to fulfill this strategy only with substantial and<br />

creditworthy multinational financial institutions. <strong>The</strong>refore, there are no risks of counterparty<br />

nonperformance nor the economic consequences of counterparty nonperformance associated with<br />

these contracts.<br />

For the most part, the caption reflects transactions opened to hedge foreign currency receivables, firm<br />

orders and future sales. Some of those covering future sales were subsequently renegotiated by<br />

entering opposite transactions. Other transactions were entered into to hedge the exchange risk on<br />

capital invested by <strong>Group</strong> companies.<br />

<strong>The</strong> estimated fair values and relating contract amounts of the <strong>Group</strong>’s financial instruments at<br />

December 31, <strong>1996</strong> are as follows (in millions of lire):<br />

Forward contracts: Fair value Contract amounts<br />

Sell currency 3,462,987 3,744,604<br />

Buy currency 1,912,543 2,050,226<br />

Notional amount<br />

Forward rate agreements 100,000<br />

Interest rate swaps 328,751<br />

Forward exchange contracts expire from January 1997 through May 1998. Included in forward<br />

contracts, sell and buy currencies are respectively Lire 1,552,285 million and Lire 459,544 million of<br />

contracts that hedge identifiable foreign currency assets, liabilities, contractual obligations or foreign<br />

investments in subsidiary companies.<br />

<strong>The</strong> interest rate swap agreements and forward rate agreements expire within three months and<br />

therefore their carrying value approximates fair value.<br />

Purchase commitments include contracts to acquire tangible fixed assets.<br />

Sale commitments relate to a subsidiary company's contract to sell retail premises.