The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

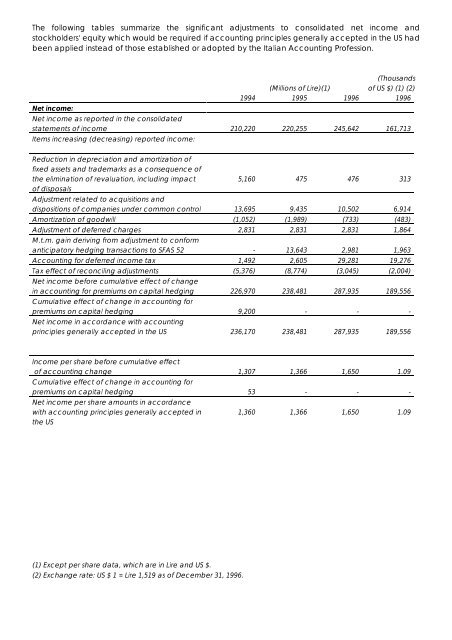

<strong>The</strong> following tables summarize the significant adjustments to consolidated net income and<br />

stockholders' equity which would be required if accounting principles generally accepted in the US had<br />

been applied instead of those established or adopted by the Italian Accounting Profession.<br />

Net income:<br />

(Millions of Lire)(1)<br />

(Thousands<br />

of US $) (1) (2)<br />

1994 1995 <strong>1996</strong> <strong>1996</strong><br />

Net income as reported in the consolidated<br />

statements of income 210,220 220,255 245,642 161,713<br />

Items increasing (decreasing) reported income:<br />

Reduction in depreciation and amortization of<br />

fixed assets and trademarks as a consequence of<br />

the elimination of revaluation, including impact<br />

of disposals<br />

Adjustment related to acquisitions and<br />

dispositions of companies under common control<br />

5,160<br />

13,695<br />

475<br />

9,435<br />

476<br />

10,502<br />

Amortization of goodwill (1,052) (1,989) (733) (483)<br />

Adjustment of deferred charges 2,831 2,831 2,831 1,864<br />

M.t.m. gain deriving from adjustment to conform<br />

anticipatory hedging transactions to SFAS 52<br />

-<br />

13,643<br />

Accounting for deferred income tax 1,492 2,605 29,281 19,276<br />

Tax effect of reconciling adjustments (5,376) (8,774) (3,045) (2,004)<br />

Net income before cumulative effect of change<br />

in accounting for premiums on capital hedging<br />

Cumulative effect of change in accounting for<br />

premiums on capital hedging<br />

Net income in accordance with accounting<br />

principles generally accepted in the US<br />

Income per share before cumulative effect<br />

of accounting change<br />

Cumulative effect of change in accounting for<br />

premiums on capital hedging<br />

Net income per share amounts in accordance<br />

with accounting principles generally accepted in<br />

the US<br />

(1) Except per share data, which are in Lire and US $.<br />

226,970<br />

9,200<br />

236,170<br />

(2) Exchange rate: US $ 1 = Lire 1,519 as of December 31, <strong>1996</strong>.<br />

1,307<br />

53<br />

1,360<br />

238,481<br />

-<br />

238,481<br />

1,366<br />

-<br />

1,366<br />

2,981<br />

287,935<br />

-<br />

287,935<br />

1,650<br />

-<br />

1,650<br />

313<br />

6,914<br />

1,963<br />

189,556<br />

-<br />

189,556<br />

1.09<br />

-<br />

1.09