The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22. ACCOUNTS PAYABLE<br />

<strong>The</strong> composition of and significant changes in this account group during the year are set out below:<br />

Bonds<br />

<strong>The</strong>se consist of the following:<br />

– EuroLire bond, guaranteed by <strong>Benetton</strong> <strong>Group</strong> S.p.A., issued on July 29, 1993, by the Dutch subsidiary<br />

<strong>Benetton</strong> International N.V., for Lire 200,000 million, bearing interest at 4.5% payable annually and<br />

repayable in 1998. <strong>The</strong> bonds carried 2,520,000 warrants, each giving the holder the right to receive,<br />

at the option of the Company’s management, either (i) one Ordinary Share which the Company<br />

would have to purchase in the stock market, or (ii) an amount in Lire equal to the closing price of one<br />

Ordinary Share on the Milan Stock Exchange (“MSE”). <strong>The</strong>se warrants were exercised at their maturity,<br />

on July 29, <strong>1996</strong>.<br />

? ?<strong>The</strong> net cost of servicing the warrants, about Lire 38,300 million, is recognized on an accrual basis that<br />

reflects the accumulation of interest. <strong>The</strong> charge for <strong>1996</strong> amounts to about Lire 5,700 million.<br />

– Bonds totaling LuxF 750 million (Lire 35,775 million at the December 31, <strong>1996</strong> exchange rate) were<br />

issued in 1994, by the subsidiary company, <strong>Benetton</strong> Finance, at a unit price of LuxF 102.25, repayable<br />

on August 4, 1999. Following an operation linked to an interest-rate swap, the bond bears interest at<br />

floating rates which, at year-end, was 8.8%. <strong>The</strong> bond is guaranteed by <strong>Benetton</strong> <strong>Group</strong> S.p.A. and<br />

listed on the Luxembourg Bourse.<br />

– Bond issued on January 27, 1992, by <strong>Benetton</strong> España S.L. for Ptas 3,000,000,000, equivalent to<br />

Lire 34,986 million at the December 31, <strong>1996</strong> exchange rate. This bond, bearing interest at an annual<br />

rate of 12.10%, was repaid in full on January 27, 1997.<br />

Convertible bonds<br />

– Ten-year bond, issued in 1988 by a Stefani <strong>Group</strong> company for Lire 300 million. This bond is convertible<br />

at par from January 1, 1998.<br />

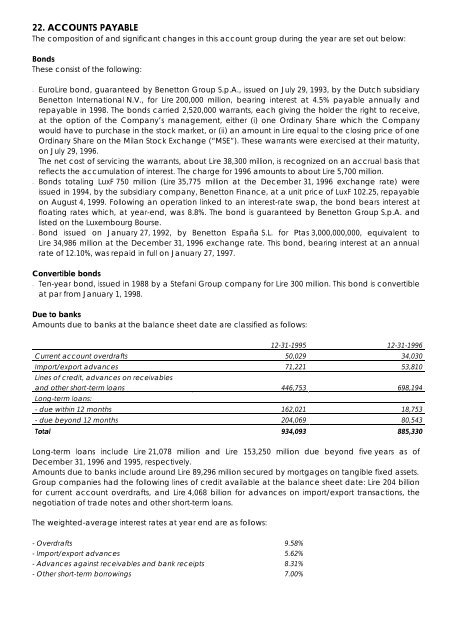

Due to banks<br />

Amounts due to banks at the balance sheet date are classified as follows:<br />

12-31-1995 12-31-<strong>1996</strong><br />

Current account overdrafts 50,029 34,030<br />

Import/export advances 71,221 53,810<br />

Lines of credit, advances on receivables<br />

and other short-term loans 446,753 698,194<br />

Long-term loans:<br />

- due within 12 months 162,021 18,753<br />

- due beyond 12 months 204,069 80,543<br />

Total 934,093 885,330<br />

Long-term loans include Lire 21,078 million and Lire 153,250 million due beyond five years as of<br />

December 31, <strong>1996</strong> and 1995, respectively.<br />

Amounts due to banks include around Lire 89,296 million secured by mortgages on tangible fixed assets.<br />

<strong>Group</strong> companies had the following lines of credit available at the balance sheet date: Lire 204 billion<br />

for current account overdrafts, and Lire 4,068 billion for advances on import/export transactions, the<br />

negotiation of trade notes and other short-term loans.<br />

<strong>The</strong> weighted-average interest rates at year end are as follows:<br />

- Overdrafts 9.58%<br />

- Import/export advances 5.62%<br />

- Advances against receivables and bank receipts 8.31%<br />

- Other short-term borrowings 7.00%