The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

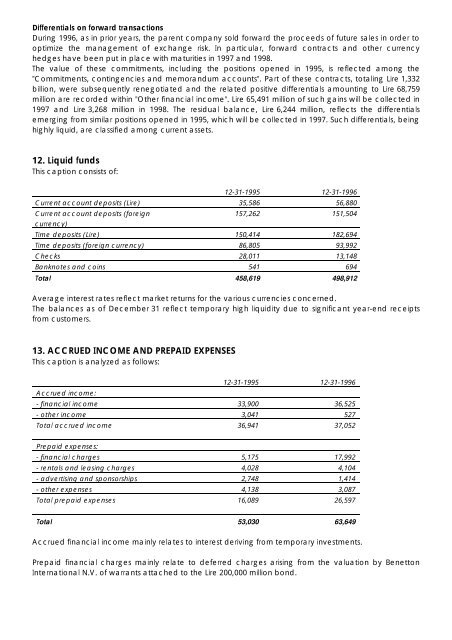

Differentials on forward transactions<br />

During <strong>1996</strong>, as in prior years, the parent company sold forward the proceeds of future sales in order to<br />

optimize the management of exchange risk. In particular, forward contracts and other currency<br />

hedges have been put in place with maturities in 1997 and 1998.<br />

<strong>The</strong> value of these commitments, including the positions opened in 1995, is reflected among the<br />

"Commitments, contingencies and memorandum accounts". Part of these contracts, totaling Lire 1,332<br />

billion, were subsequently renegotiated and the related positive differentials amounting to Lire 68,759<br />

million are recorded within "Other financial income". Lire 65,491 million of such gains will be collected in<br />

1997 and Lire 3,268 million in 1998. <strong>The</strong> residual balance, Lire 6,244 million, reflects the differentials<br />

emerging from similar positions opened in 1995, which will be collected in 1997. Such differentials, being<br />

highly liquid, are classified among current assets.<br />

12. Liquid funds<br />

This caption consists of:<br />

12-31-1995 12-31-<strong>1996</strong><br />

Current account deposits (Lire) 35,586 56,880<br />

Current account deposits (foreign<br />

currency)<br />

157,262 151,504<br />

Time deposits (Lire) 150,414 182,694<br />

Time deposits (foreign currency) 86,805 93,992<br />

Checks 28,011 13,148<br />

Banknotes and coins 541 694<br />

Total 458,619 498,912<br />

Average interest rates reflect market returns for the various currencies concerned.<br />

<strong>The</strong> balances as of December 31 reflect temporary high liquidity due to significant year-end receipts<br />

from customers.<br />

13. ACCRUED INCOME AND PREPAID EXPENSES<br />

This caption is analyzed as follows:<br />

Accrued income:<br />

12-31-1995 12-31-<strong>1996</strong><br />

- financial income 33,900 36,525<br />

- other income 3,041 527<br />

Total accrued income<br />

Prepaid expenses:<br />

36,941 37,052<br />

- financial charges 5,175 17,992<br />

- rentals and leasing charges 4,028 4,104<br />

- advertising and sponsorships 2,748 1,414<br />

- other expenses 4,138 3,087<br />

Total prepaid expenses<br />

16,089 26,597<br />

Total 53,030 63,649<br />

Accrued financial income mainly relates to interest deriving from temporary investments.<br />

Prepaid financial charges mainly relate to deferred charges arising from the valuation by <strong>Benetton</strong><br />

International N.V. of warrants attached to the Lire 200,000 million bond.