The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

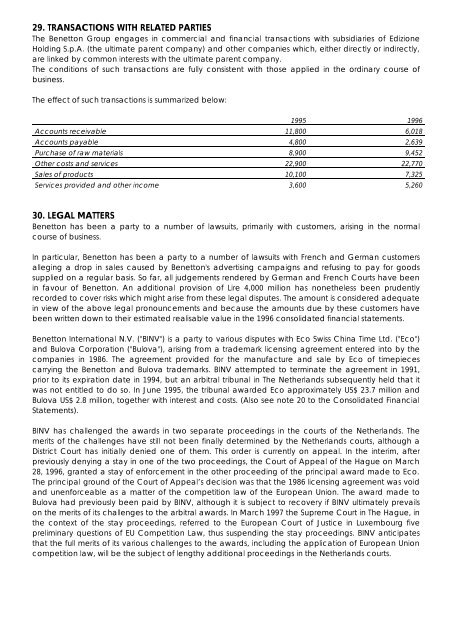

29. TRANSACTIONS WITH RELATED PARTIES<br />

<strong>The</strong> <strong>Benetton</strong> <strong>Group</strong> engages in commercial and financial transactions with subsidiaries of Edizione<br />

Holding S.p.A. (the ultimate parent company) and other companies which, either directly or indirectly,<br />

are linked by common interests with the ultimate parent company.<br />

<strong>The</strong> conditions of such transactions are fully consistent with those applied in the ordinary course of<br />

business.<br />

<strong>The</strong> effect of such transactions is summarized below:<br />

1995 <strong>1996</strong><br />

Accounts receivable 11,800 6,018<br />

Accounts payable 4,800 2,639<br />

Purchase of raw materials 8,900 9,452<br />

Other costs and services 22,900 22,770<br />

Sales of products 10,100 7,325<br />

Services provided and other income 3,600 5,260<br />

30. LEGAL MATTERS<br />

<strong>Benetton</strong> has been a party to a number of lawsuits, primarily with customers, arising in the normal<br />

course of business.<br />

In particular, <strong>Benetton</strong> has been a party to a number of lawsuits with French and German customers<br />

alleging a drop in sales caused by <strong>Benetton</strong>'s advertising campaigns and refusing to pay for goods<br />

supplied on a regular basis. So far, all judgements rendered by German and French Courts have been<br />

in favour of <strong>Benetton</strong>. An additional provision of Lire 4,000 million has nonetheless been prudently<br />

recorded to cover risks which might arise from these legal disputes. <strong>The</strong> amount is considered adequate<br />

in view of the above legal pronouncements and because the amounts due by these customers have<br />

been written down to their estimated realisable value in the <strong>1996</strong> consolidated financial statements.<br />

<strong>Benetton</strong> International N.V. ("BINV") is a party to various disputes with Eco Swiss China Time Ltd. ("Eco")<br />

and Bulova Corporation ("Bulova"), arising from a trademark licensing agreement entered into by the<br />

companies in 1986. <strong>The</strong> agreement provided for the manufacture and sale by Eco of timepieces<br />

carrying the <strong>Benetton</strong> and Bulova trademarks. BINV attempted to terminate the agreement in 1991,<br />

prior to its expiration date in 1994, but an arbitral tribunal in <strong>The</strong> Netherlands subsequently held that it<br />

was not entitled to do so. In June 1995, the tribunal awarded Eco approximately US$ 23.7 million and<br />

Bulova US$ 2.8 million, together with interest and costs. (Also see note 20 to the Consolidated Financial<br />

Statements).<br />

BINV has challenged the awards in two separate proceedings in the courts of the Netherlands. <strong>The</strong><br />

merits of the challenges have still not been finally determined by the Netherlands courts, although a<br />

District Court has initially denied one of them. This order is currently on appeal. In the interim, after<br />

previously denying a stay in one of the two proceedings, the Court of Appeal of the Hague on March<br />

28, <strong>1996</strong>, granted a stay of enforcement in the other proceeding of the principal award made to Eco.<br />

<strong>The</strong> principal ground of the Court of Appeal’s decision was that the 1986 licensing agreement was void<br />

and unenforceable as a matter of the competition law of the European Union. <strong>The</strong> award made to<br />

Bulova had previously been paid by BINV, although it is subject to recovery if BINV ultimately prevails<br />

on the merits of its challenges to the arbitral awards. In March 1997 the Supreme Court in <strong>The</strong> Hague, in<br />

the context of the stay proceedings, referred to the European Court of Justice in Luxembourg five<br />

preliminary questions of EU Competition Law, thus suspending the stay proceedings. BINV anticipates<br />

that the full merits of its various challenges to the awards, including the application of European Union<br />

competition law, will be the subject of lengthy additional proceedings in the Netherlands courts.