The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

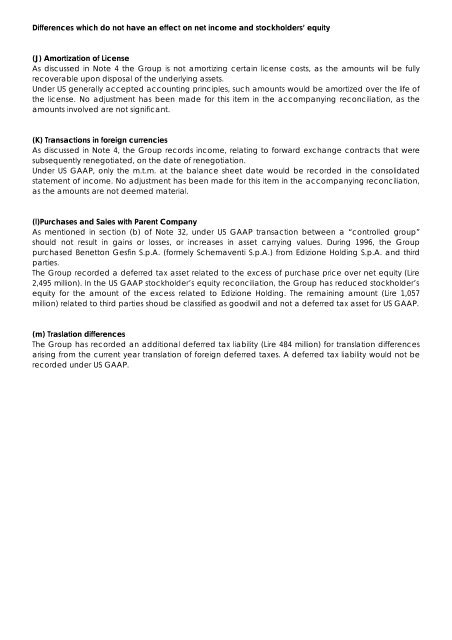

Differences which do not have an effect on net income and stockholders’ equity<br />

(J) Amortization of License<br />

As discussed in Note 4 the <strong>Group</strong> is not amortizing certain license costs, as the amounts will be fully<br />

recoverable upon disposal of the underlying assets.<br />

Under US generally accepted accounting principles, such amounts would be amortized over the life of<br />

the license. No adjustment has been made for this item in the accompanying reconciliation, as the<br />

amounts involved are not significant.<br />

(K) Transactions in foreign currencies<br />

As discussed in Note 4, the <strong>Group</strong> records income, relating to forward exchange contracts that were<br />

subsequently renegotiated, on the date of renegotiation.<br />

Under US GAAP, only the m.t.m. at the balance sheet date would be recorded in the consolidated<br />

statement of income. No adjustment has been made for this item in the accompanying reconciliation,<br />

as the amounts are not deemed material.<br />

(l)Purchases and Sales with Parent Company<br />

As mentioned in section (b) of Note 32, under US GAAP transaction between a “controlled group”<br />

should not result in gains or losses, or increases in asset carrying values. During <strong>1996</strong>, the <strong>Group</strong><br />

purchased <strong>Benetton</strong> Gesfin S.p.A. (formely Schemaventi S.p.A.) from Edizione Holding S.p.A. and third<br />

parties.<br />

<strong>The</strong> <strong>Group</strong> recorded a deferred tax asset related to the excess of purchase price over net equity (Lire<br />

2,495 million). In the US GAAP stockholder’s equity reconciliation, the <strong>Group</strong> has reduced stockholder’s<br />

equity for the amount of the excess related to Edizione Holding. <strong>The</strong> remaining amount (Lire 1,057<br />

million) related to third parties shoud be classified as goodwill and not a deferred tax asset for US GAAP.<br />

(m) Traslation differences<br />

<strong>The</strong> <strong>Group</strong> has recorded an additional deferred tax liability (Lire 484 million) for translation differences<br />

arising from the current year translation of foreign deferred taxes. A deferred tax liability would not be<br />

recorded under US GAAP.