The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

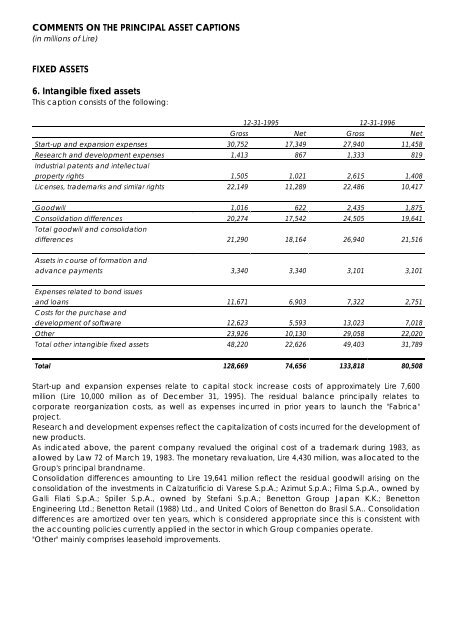

COMMENTS ON THE PRINCIPAL ASSET CAPTIONS<br />

(in millions of Lire)<br />

FIXED ASSETS<br />

6. Intangible fixed assets<br />

This caption consists of the following:<br />

12-31-1995 12-31-<strong>1996</strong><br />

Gross Net Gross Net<br />

Start-up and expansion expenses 30,752 17,349 27,940 11,458<br />

Research and development expenses 1,413 867 1,333 819<br />

Industrial patents and intellectual<br />

property rights<br />

Licenses, trademarks and similar rights 22,149 11,289 22,486 10,417<br />

Goodwill 1,016 622 2,435 1,875<br />

Consolidation differences 20,274 17,542 24,505 19,641<br />

Total goodwill and consolidation<br />

differences<br />

Assets in course of formation and<br />

advance payments<br />

Expenses related to bond issues<br />

and loans<br />

Costs for the purchase and<br />

development of software<br />

1,505<br />

21,290<br />

3,340<br />

11,671<br />

12,623<br />

1,021<br />

18,164<br />

3,340<br />

6,903<br />

5,593<br />

2,615<br />

26,940<br />

3,101<br />

7,322<br />

13,023<br />

1,408<br />

21,516<br />

Other 23,926 10,130 29,058 22,020<br />

Total other intangible fixed assets<br />

48,220 22,626<br />

3,101<br />

2,751<br />

7,018<br />

49,403 31,789<br />

Total 128,669 74,656 133,818 80,508<br />

Start-up and expansion expenses relate to capital stock increase costs of approximately Lire 7,600<br />

million (Lire 10,000 million as of December 31, 1995). <strong>The</strong> residual balance principally relates to<br />

corporate reorganization costs, as well as expenses incurred in prior years to launch the "Fabrica"<br />

project.<br />

Research and development expenses reflect the capitalization of costs incurred for the development of<br />

new products.<br />

As indicated above, the parent company revalued the original cost of a trademark during 1983, as<br />

allowed by Law 72 of March 19, 1983. <strong>The</strong> monetary revaluation, Lire 4,430 million, was allocated to the<br />

<strong>Group</strong>'s principal brandname.<br />

Consolidation differences amounting to Lire 19,641 million reflect the residual goodwill arising on the<br />

consolidation of the investments in Calzaturificio di Varese S.p.A.; Azimut S.p.A.; Filma S.p.A., owned by<br />

Galli Filati S.p.A.; Spiller S.p.A., owned by Stefani S.p.A.; <strong>Benetton</strong> <strong>Group</strong> Japan K.K.; <strong>Benetton</strong><br />

Engineering Ltd.; <strong>Benetton</strong> Retail (1988) Ltd., and United Colors of <strong>Benetton</strong> do Brasil S.A.. Consolidation<br />

differences are amortized over ten years, which is considered appropriate since this is consistent with<br />

the accounting policies currently applied in the sector in which <strong>Group</strong> companies operate.<br />

"Other" mainly comprises leasehold improvements.