The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

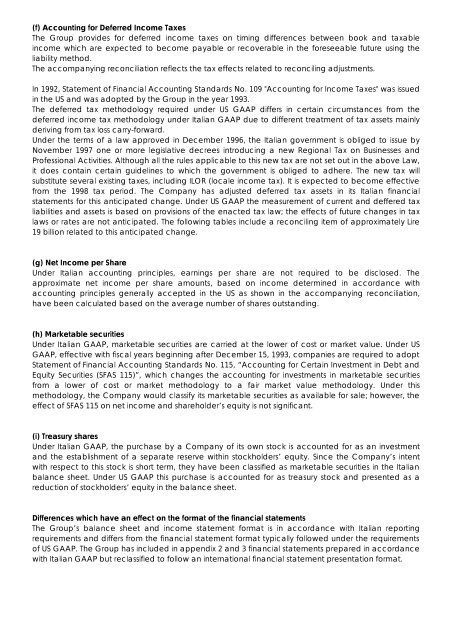

(f) Accounting for Deferred Income Taxes<br />

<strong>The</strong> <strong>Group</strong> provides for deferred income taxes on timing differences between book and taxable<br />

income which are expected to become payable or recoverable in the foreseeable future using the<br />

liability method.<br />

<strong>The</strong> accompanying reconciliation reflects the tax effects related to reconciling adjustments.<br />

In 1992, Statement of Financial Accounting Standards No. 109 "Accounting for Income Taxes" was issued<br />

in the US and was adopted by the <strong>Group</strong> in the year 1993.<br />

<strong>The</strong> deferred tax methodology required under US GAAP differs in certain circumstances from the<br />

deferred income tax methodology under Italian GAAP due to different treatment of tax assets mainly<br />

deriving from tax loss carry-forward.<br />

Under the terms of a law approved in December <strong>1996</strong>, the Italian government is obliged to issue by<br />

November 1997 one or more legislative decrees introducing a new Regional Tax on Businesses and<br />

Professional Activities. Although all the rules applicable to this new tax are not set out in the above Law,<br />

it does contain certain guidelines to which the government is obliged to adhere. <strong>The</strong> new tax will<br />

substitute several existing taxes, including ILOR (locale income tax). It is expected to become effective<br />

from the 1998 tax period. <strong>The</strong> Company has adjusted deferred tax assets in its Italian financial<br />

statements for this anticipated change. Under US GAAP the measurement of current and deffered tax<br />

liabilities and assets is based on provisions of the enacted tax law; the effects of future changes in tax<br />

laws or rates are not anticipated. <strong>The</strong> following tables include a reconciling item of approximately Lire<br />

19 billion related to this anticipated change.<br />

(g) Net Income per Share<br />

Under Italian accounting principles, earnings per share are not required to be disclosed. <strong>The</strong><br />

approximate net income per share amounts, based on income determined in accordance with<br />

accounting principles generally accepted in the US as shown in the accompanying reconciliation,<br />

have been calculated based on the average number of shares outstanding.<br />

(h) Marketable securities<br />

Under Italian GAAP, marketable securities are carried at the lower of cost or market value. Under US<br />

GAAP, effective with fiscal years beginning after December 15, 1993, companies are required to adopt<br />

Statement of Financial Accounting Standards No. 115, “Accounting for Certain Investment in Debt and<br />

Equity Securities (SFAS 115)”, which changes the accounting for investments in marketable securities<br />

from a lower of cost or market methodology to a fair market value methodology. Under this<br />

methodology, the Company would classify its marketable securities as available for sale; however, the<br />

effect of SFAS 115 on net income and shareholder’s equity is not significant.<br />

(i) Treasury shares<br />

Under Italian GAAP, the purchase by a Company of its own stock is accounted for as an investment<br />

and the establishment of a separate reserve within stockholders’ equity. Since the Company’s intent<br />

with respect to this stock is short term, they have been classified as marketable securities in the Italian<br />

balance sheet. Under US GAAP this purchase is accounted for as treasury stock and presented as a<br />

reduction of stockholders’ equity in the balance sheet.<br />

Differences which have an effect on the format of the financial statements<br />

<strong>The</strong> <strong>Group</strong>’s balance sheet and income statement format is in accordance with Italian reporting<br />

requirements and differs from the financial statement format typically followed under the requirements<br />

of US GAAP. <strong>The</strong> <strong>Group</strong> has included in appendix 2 and 3 financial statements prepared in accordance<br />

with Italian GAAP but reclassified to follow an international financial statement presentation format.