The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

With regard to the dispute with Eco Swiss China Time Ltd. and Bulova Corp., ongoing legal procedures<br />

seek to quash or overturn the arbitration award of June 23, 1995, which ordered <strong>Benetton</strong><br />

International N.V. to pay compensation of US$ 23.7 million to Eco Swiss China Time Ltd. and US$ 2.8<br />

million to Bulova Corp., together with costs and the related interest.<br />

Stockholders will remember that in 1986, <strong>Benetton</strong> International N.V., a subsidiary of <strong>Benetton</strong><br />

<strong>Group</strong> S.p.A., signed a license contract with Eco Swiss China Time Ltd. (the licensee) and Bulova Corp.<br />

(colicensee) for the use of the <strong>Benetton</strong> trademark in the timepiece sector. <strong>The</strong> duration of the contract<br />

was eight years and therefore expired in 1994.<br />

Significant problems in the relationship with Eco Swiss China Time Ltd. began to emerge at the end of<br />

1989, such that, in 1991, <strong>Benetton</strong> International N.V. sent that company a letter notifying its intention to<br />

terminate the contract. <strong>The</strong> grounds indicated by <strong>Benetton</strong> were essentially that:<br />

– royalties were not being paid, or were inadequate;<br />

– the license was effectively being sublicensed to a subsidiary company of Eco Swiss China Time Ltd.;<br />

– the company refused to accept its share of the audit fees incurred by Arthur Andersen;<br />

– a number of group companies had gone bankrupt (including Eco Swiss S.p.A., the European<br />

subholding of the Eco Swiss <strong>Group</strong>).<br />

Eco Swiss China Time Ltd. and Bulova Corp. did not accept the termination of the contract and, on the<br />

basis of an arbitration clause, took the case to arbitration in the Netherlands.<br />

<strong>Benetton</strong> International N.V. presented two appeals against the award: the first, based on the merits of<br />

the case, requesting that the award be quashed, and the second, raising objections based on legal<br />

grounds, that the award be overturned.<br />

<strong>Benetton</strong> International N.V., having previously applied for a stay of execution, obtained through the<br />

courts a temporary stay in regard to Eco Swiss China Time Ltd., pending the decision of the competent<br />

tribunals on the questions indicated above.<br />

On March 21, 1997, the Supreme Court in <strong>The</strong> Hague accepted the petition by <strong>Benetton</strong><br />

International N.V. and remitted the case for consideration by the European Court of Justice in<br />

Luxembourg. This decision has had favorable consequences for <strong>Benetton</strong> International N.V., since it also<br />

resulted in the adjournment of proceedings before the Supreme Court in <strong>The</strong> Hague concerning a<br />

request by Eco Swiss China Time Ltd. to lift the stay of execution on the payment of the arbitration<br />

award.<br />

This positive result encourages <strong>Benetton</strong> International N.V. in the defense of its case and interests. Any<br />

risks which could emerge from the final outcome of proceedings are adequately covered by existing<br />

provisions.<br />

<strong>The</strong> agents' leaving indemnity reserve was created in prior years and is prudently maintained to reflect<br />

contingencies associated with the interruption of agency contracts in certain circumstances covered<br />

by Italian law. <strong>The</strong> provision of an additional Lire 9,282 million during <strong>1996</strong> follows utilizations during the<br />

year.<br />

<strong>The</strong> exchange fluctuation reserve reflects the net effect of adjusting the unhedged foreign currency<br />

receivables and payables of Italian companies in the <strong>Group</strong> using year-end exchange rates.<br />

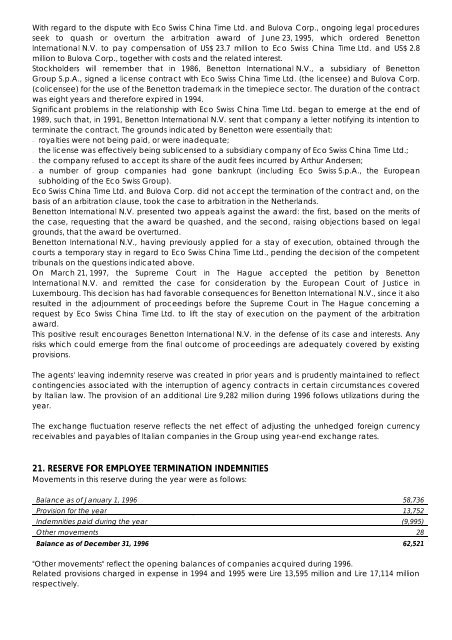

21. RESERVE FOR EMPLOYEE TERMINATION INDEMNITIES<br />

Movements in this reserve during the year were as follows:<br />

Balance as of January 1, <strong>1996</strong> 58,736<br />

Provision for the year 13,752<br />

Indemnities paid during the year (9,995)<br />

Other movements 28<br />

Balance as of December 31, <strong>1996</strong> 62,521<br />

"Other movements" reflect the opening balances of companies acquired during <strong>1996</strong>.<br />

Related provisions charged in expense in 1994 and 1995 were Lire 13,595 million and Lire 17,114 million<br />

respectively.