The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

The Benetton Group Annual Report 1996

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Writedowns<br />

<strong>The</strong> "Writedown of current receivables and of liquid funds", Lire 78,304 million, reflects a prudent<br />

provision to the allowance for doubtful accounts. This is discussed in more detail in the note on trade<br />

accounts receivable.<br />

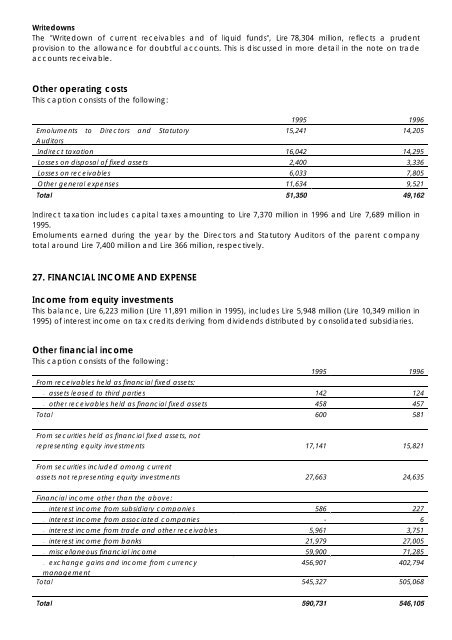

Other operating costs<br />

This caption consists of the following:<br />

Emoluments to Directors and Statutory<br />

Auditors<br />

1995 <strong>1996</strong><br />

15,241 14,205<br />

Indirect taxation 16,042 14,295<br />

Losses on disposal of fixed assets 2,400 3,336<br />

Losses on receivables 6,033 7,805<br />

Other general expenses 11,634 9,521<br />

Total 51,350 49,162<br />

Indirect taxation includes capital taxes amounting to Lire 7,370 million in <strong>1996</strong> and Lire 7,689 million in<br />

1995.<br />

Emoluments earned during the year by the Directors and Statutory Auditors of the parent company<br />

total around Lire 7,400 million and Lire 366 million, respectively.<br />

27. FINANCIAL INCOME AND EXPENSE<br />

Income from equity investments<br />

This balance, Lire 6,223 million (Lire 11,891 million in 1995), includes Lire 5,948 million (Lire 10,349 million in<br />

1995) of interest income on tax credits deriving from dividends distributed by consolidated subsidiaries.<br />

Other financial income<br />

This caption consists of the following:<br />

From receivables held as financial fixed assets:<br />

1995 <strong>1996</strong><br />

– assets leased to third parties 142 124<br />

– other receivables held as financial fixed assets 458 457<br />

Total 600 581<br />

From securities held as financial fixed assets, not<br />

representing equity investments<br />

From securities included among current<br />

assets not representing equity investments<br />

Financial income other than the above:<br />

17,141<br />

27,663<br />

15,821<br />

24,635<br />

– interest income from subsidiary companies 586 227<br />

– interest income from associated companies - 6<br />

– interest income from trade and other receivables 5,961 3,751<br />

– interest income from banks 21,979 27,005<br />

– miscellaneous financial income 59,900 71,285<br />

– exchange gains and income from currency<br />

456,901 402,794<br />

management<br />

Total 545,327 505,068<br />

Total 590,731 546,105