preface

preface

preface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

106<br />

TAXATION<br />

Under the recent tax reform, the above exemption will also apply to<br />

securities purchased prior to being listed. Tax will be charged at the<br />

time of sale only on that part of the capital gains generated until the<br />

securities are listed (capital gains on a notional sale).<br />

(c) exemption from capital gains on the sale of Israeli securities acquired<br />

after January 2009.<br />

8.2.2. Companies<br />

8.2.2.1. Domicile of a Corporate Entity<br />

The domicile of a corporate entity is determined on the basis of<br />

two alternative criteria:<br />

(a) If incorporated in Israel.<br />

(b) The corporate entity is managed and controlled from Israel.<br />

A foreign company’s business managed and controlled in Israel<br />

by new immigrants or veteran returning residents will not be<br />

considered an Israeli resident’s business for ten years after the<br />

assumption of residence (if, apart from being managed and<br />

controlled by new immigrants or veteran returning residents,<br />

they would not have been classified as Israeli residents).<br />

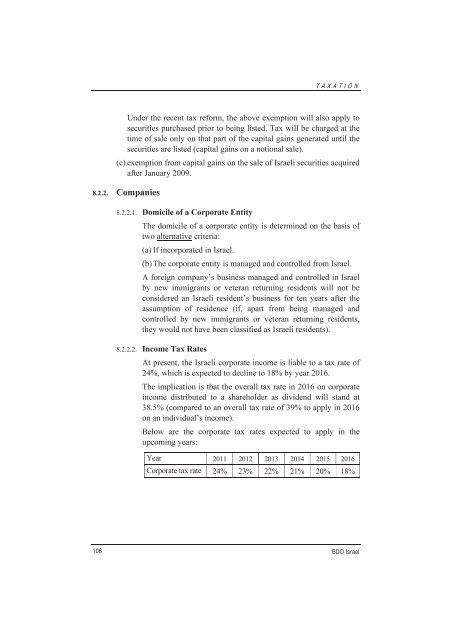

8.2.2.2. Income Tax Rates<br />

At present, the Israeli corporate income is liable to a tax rate of<br />

24%, which is expected to decline to 18% by year 2016.<br />

The implication is that the overall tax rate in 2016 on corporate<br />

income distributed to a shareholder as dividend will stand at<br />

38.5% (compared to an overall tax rate of 39% to apply in 2016<br />

on an individual’s income).<br />

Below are the corporate tax rates expected to apply in the<br />

upcoming years:<br />

Year 2011 2012 2013 2014 2015 2016<br />

Corporate tax rate 24% 23% 22% 21% 20% 18%<br />

BDO Israel