preface

preface

preface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8.10. TAX TREATIES<br />

136<br />

TAXATION<br />

As of January 2011, Israel is party to some 50 double taxation treaties. Part of<br />

these have recently been signed, while in the case of others, the Ministry of<br />

Finance is holding discussions with the relevant countries with a view to<br />

renewing the treaties, usually by applying all or part of the provisions of the<br />

OECD model.<br />

Meanwhile, new double taxation treaties were recently signed with Denmark<br />

and the U.K., designed to replace the old ones. Furthermore, a treaty has for<br />

the first time been signed with Georgia. These are expected to become effective<br />

once they have been ratified by Israel and the relevant countries.<br />

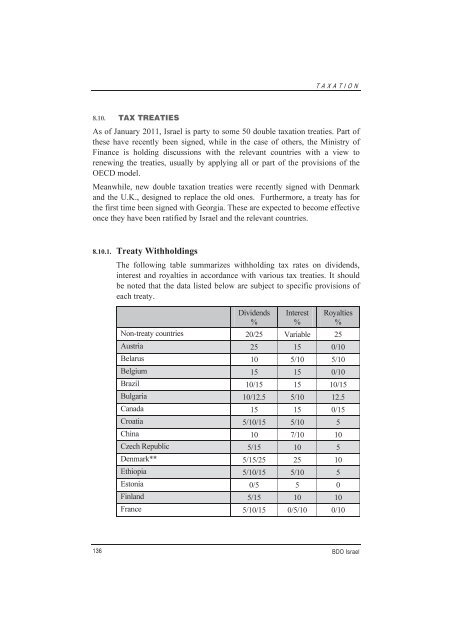

8.10.1. Treaty Withholdings<br />

The following table summarizes withholding tax rates on dividends,<br />

interest and royalties in accordance with various tax treaties. It should<br />

be noted that the data listed below are subject to specific provisions of<br />

each treaty.<br />

Dividends<br />

%<br />

Interest<br />

%<br />

Royalties<br />

%<br />

Non-treaty countries 20/25 Variable 25<br />

Austria 25 15 0/10<br />

Belarus 10 5/10 5/10<br />

Belgium 15 15 0/10<br />

Brazil 10/15 15 10/15<br />

Bulgaria 10/12.5 5/10 12.5<br />

Canada 15 15 0/15<br />

Croatia 5/10/15 5/10 5<br />

China 10 7/10 10<br />

Czech Republic 5/15 10 5<br />

Denmark** 5/15/25 25 10<br />

Ethiopia 5/10/15 5/10 5<br />

Estonia 0/5 5 0<br />

Finland 5/15 10 10<br />

France 5/10/15 0/5/10 0/10<br />

BDO Israel