preface

preface

preface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

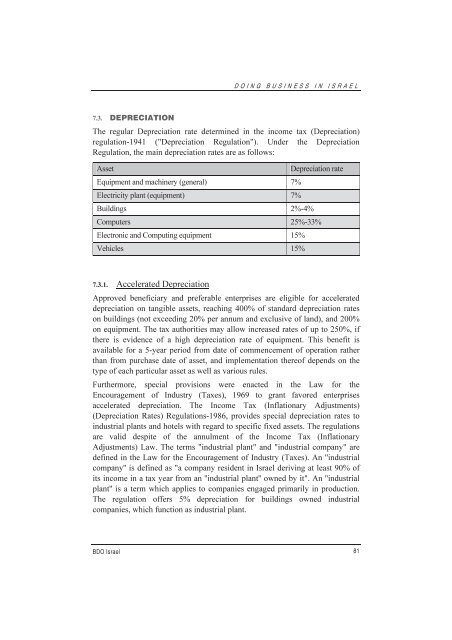

7.3. DEPRECIATION<br />

BDO Israel<br />

DOING BUSINESS IN ISRAEL<br />

The regular Depreciation rate determined in the income tax (Depreciation)<br />

regulation-1941 ("Depreciation Regulation"). Under the Depreciation<br />

Regulation, the main depreciation rates are as follows:<br />

Asset Depreciation rate<br />

Equipment and machinery (general) 7%<br />

Electricity plant (equipment) 7%<br />

Buildings 2%-4%<br />

Computers 25%-33%<br />

Electronic and Computing equipment 15%<br />

Vehicles 15%<br />

7.3.1. Accelerated Depreciation<br />

Approved beneficiary and preferable enterprises are eligible for accelerated<br />

depreciation on tangible assets, reaching 400% of standard depreciation rates<br />

on buildings (not exceeding 20% per annum and exclusive of land), and 200%<br />

on equipment. The tax authorities may allow increased rates of up to 250%, if<br />

there is evidence of a high depreciation rate of equipment. This benefit is<br />

available for a 5-year period from date of commencement of operation rather<br />

than from purchase date of asset, and implementation thereof depends on the<br />

type of each particular asset as well as various rules.<br />

Furthermore, special provisions were enacted in the Law for the<br />

Encouragement of Industry (Taxes), 1969 to grant favored enterprises<br />

accelerated depreciation. The Income Tax (Inflationary Adjustments)<br />

(Depreciation Rates) Regulations-1986, provides special depreciation rates to<br />

industrial plants and hotels with regard to specific fixed assets. The regulations<br />

are valid despite of the annulment of the Income Tax (Inflationary<br />

Adjustments) Law. The terms "industrial plant" and "industrial company" are<br />

defined in the Law for the Encouragement of Industry (Taxes). An ''industrial<br />

company'' is defined as "a company resident in Israel deriving at least 90% of<br />

its income in a tax year from an ''industrial plant'' owned by it". An ''industrial<br />

plant'' is a term which applies to companies engaged primarily in production.<br />

The regulation offers 5% depreciation for buildings owned industrial<br />

companies, which function as industrial plant.<br />

81