preface

preface

preface

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

82<br />

INVESTMENT INCENTIVES AND TRADE ADVANTAGES<br />

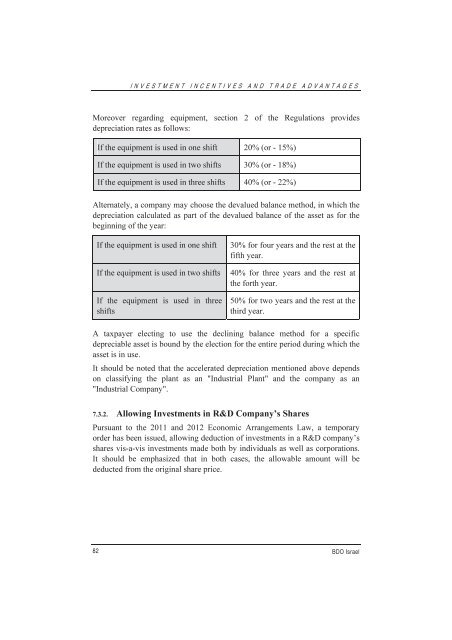

Moreover regarding equipment, section 2 of the Regulations provides<br />

depreciation rates as follows:<br />

If the equipment is used in one shift 20% (or - 15%)<br />

If the equipment is used in two shifts 30% (or - 18%)<br />

If the equipment is used in three shifts 40% (or - 22%)<br />

Alternately, a company may choose the devalued balance method, in which the<br />

depreciation calculated as part of the devalued balance of the asset as for the<br />

beginning of the year:<br />

If the equipment is used in one shift 30% for four years and the rest at the<br />

fifth year.<br />

If the equipment is used in two shifts 40% for three years and the rest at<br />

the forth year.<br />

If the equipment is used in three<br />

shifts<br />

50% for two years and the rest at the<br />

third year.<br />

A taxpayer electing to use the declining balance method for a specific<br />

depreciable asset is bound by the election for the entire period during which the<br />

asset is in use.<br />

It should be noted that the accelerated depreciation mentioned above depends<br />

on classifying the plant as an "Industrial Plant" and the company as an<br />

"Industrial Company".<br />

7.3.2. Allowing Investments in R&D Company’s Shares<br />

Pursuant to the 2011 and 2012 Economic Arrangements Law, a temporary<br />

order has been issued, allowing deduction of investments in a R&D company’s<br />

shares vis-a-vis investments made both by individuals as well as corporations.<br />

It should be emphasized that in both cases, the allowable amount will be<br />

deducted from the original share price.<br />

BDO Israel