preface

preface

preface

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Example<br />

A<br />

NIS<br />

Example<br />

B<br />

NIS<br />

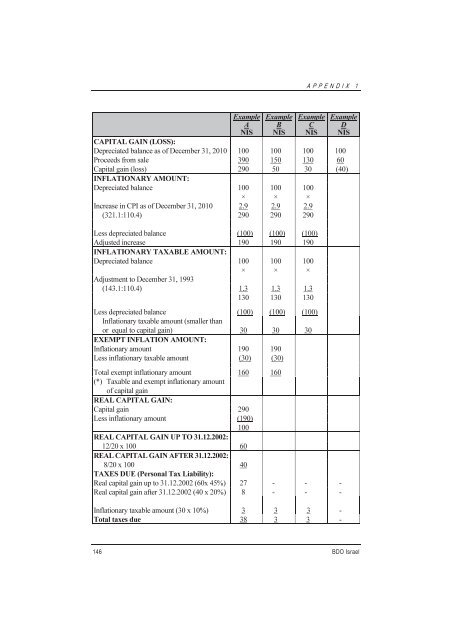

APPENDIX 1<br />

Example<br />

C<br />

NIS<br />

Example<br />

D<br />

NIS<br />

CAPITAL GAIN (LOSS):<br />

Depreciated balance as of December 31, 2010 100 100 100 100<br />

Proceeds from sale 390 150 130 60<br />

Capital gain (loss) 290 50 30 (40)<br />

INFLATIONARY AMOUNT:<br />

Depreciated balance 100 100 100<br />

× × ×<br />

Increase in CPI as of December 31, 2010 2.9 2.9 2.9<br />

(321.1:110.4) 290 290 290<br />

Less depreciated balance (100) (100) (100)<br />

Adjusted increase 190 190 190<br />

INFLATIONARY TAXABLE AMOUNT:<br />

Depreciated balance 100 100 100<br />

× × ×<br />

Adjustment to December 31, 1993<br />

(143.1:110.4) 1.3 1.3 1.3<br />

130 130 130<br />

Less depreciated balance<br />

Inflationary taxable amount (smaller than<br />

(100) (100) (100)<br />

or equal to capital gain)<br />

EXEMPT INFLATION AMOUNT:<br />

30 30 30<br />

Inflationary amount 190 190<br />

Less inflationary taxable amount (30) (30)<br />

Total exempt inflationary amount 160 160<br />

(*) Taxable and exempt inflationary amount<br />

of capital gain<br />

REAL CAPITAL GAIN:<br />

Capital gain 290<br />

Less inflationary amount (190)<br />

100<br />

REAL CAPITAL GAIN UP TO 31.12.2002:<br />

12/20 x 100 60<br />

REAL CAPITAL GAIN AFTER 31.12.2002:<br />

8/20 x 100 40<br />

TAXES DUE (Personal Tax Liability):<br />

Real capital gain up to 31.12.2002 (60x 45%) 27 - - -<br />

Real capital gain after 31.12.2002 (40 x 20%) 8 - - -<br />

Inflationary taxable amount (30 x 10%) 3 3 3 -<br />

Total taxes due 38 3 3 -<br />

146 BDO Israel