preface

preface

preface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BDO Israel<br />

DOING BUSINESS IN ISRAEL<br />

The ceiling creates an effective 57% tax rate, 45% income tax and 12%<br />

social security, on a monthly income of NIS 40,230 - NIS 73,422.<br />

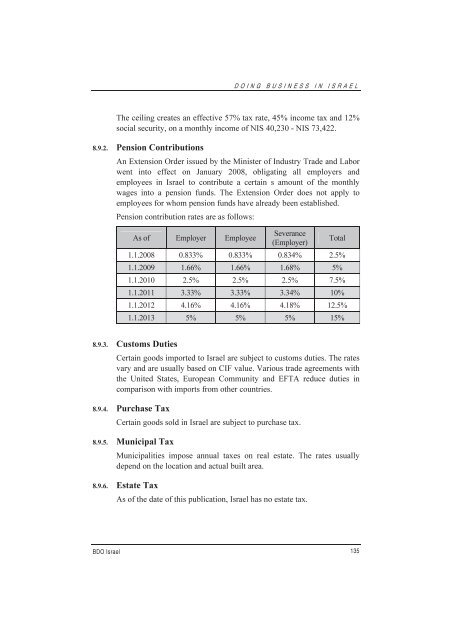

8.9.2. Pension Contributions<br />

An Extension Order issued by the Minister of Industry Trade and Labor<br />

went into effect on January 2008, obligating all employers and<br />

employees in Israel to contribute a certain s amount of the monthly<br />

wages into a pension funds. The Extension Order does not apply to<br />

employees for whom pension funds have already been established.<br />

Pension contribution rates are as follows:<br />

As of Employer Employee<br />

Severance<br />

(Employer)<br />

Total<br />

1.1.2008 0.833% 0.833% 0.834% 2.5%<br />

1.1.2009 1.66% 1.66% 1.68% 5%<br />

1.1.2010 2.5% 2.5% 2.5% 7.5%<br />

1.1.2011 3.33% 3.33% 3.34% 10%<br />

1.1.2012 4.16% 4.16% 4.18% 12.5%<br />

1.1.2013 5% 5% 5% 15%<br />

8.9.3. Customs Duties<br />

Certain goods imported to Israel are subject to customs duties. The rates<br />

vary and are usually based on CIF value. Various trade agreements with<br />

the United States, European Community and EFTA reduce duties in<br />

comparison with imports from other countries.<br />

8.9.4. Purchase Tax<br />

Certain goods sold in Israel are subject to purchase tax.<br />

8.9.5. Municipal Tax<br />

Municipalities impose annual taxes on real estate. The rates usually<br />

depend on the location and actual built area.<br />

8.9.6. Estate Tax<br />

As of the date of this publication, Israel has no estate tax.<br />

135