preface

preface

preface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

24<br />

OVERVIEW OF ISRAEL’S HIGH-TECH INDUSTRY<br />

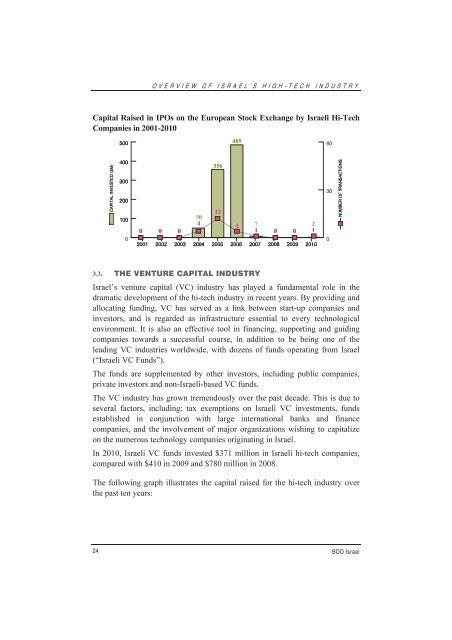

Capital Raised in IPOs on the European Stock Exchange by Israeli Hi-Tech<br />

Companies in 2001-2010<br />

50<br />

12<br />

0 0 0<br />

4<br />

4 7<br />

1 0 0<br />

2<br />

1<br />

0 0<br />

3.3. THE VENTURE CAPITAL INDUSTRY<br />

Israel’s venture capital (VC) industry has played a fundamental role in the<br />

dramatic development of the hi-tech industry in recent years. By providing and<br />

allocating funding, VC has served as a link between start-up companies and<br />

investors, and is regarded as infrastructure essential to every technological<br />

environment. It is also an effective tool in financing, supporting and guiding<br />

companies towards a successful course, in addition to be being one of the<br />

leading VC industries worldwide, with dozens of funds operating from Israel<br />

(“Israeli VC Funds”).<br />

The funds are supplemented by other investors, including public companies,<br />

private investors and non-Israeli-based VC funds.<br />

The VC industry has grown tremendously over the past decade. This is due to<br />

several factors, including: tax exemptions on Israeli VC investments, funds<br />

established in conjunction with large international banks and finance<br />

companies, and the involvement of major organizations wishing to capitalize<br />

on the numerous technology companies originating in Israel.<br />

In 2010, Israeli VC funds invested $371 million in Israeli hi-tech companies,<br />

compared with $410 in 2009 and $780 million in 2008.<br />

The following graph illustrates the capital raised for the hi-tech industry over<br />

the past ten years:<br />

60<br />

30<br />

BDO Israel