Institutional Mechanisms for REDD+ - Case Studies Working Paper

Institutional Mechanisms for REDD+ - Case Studies Working Paper

Institutional Mechanisms for REDD+ - Case Studies Working Paper

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

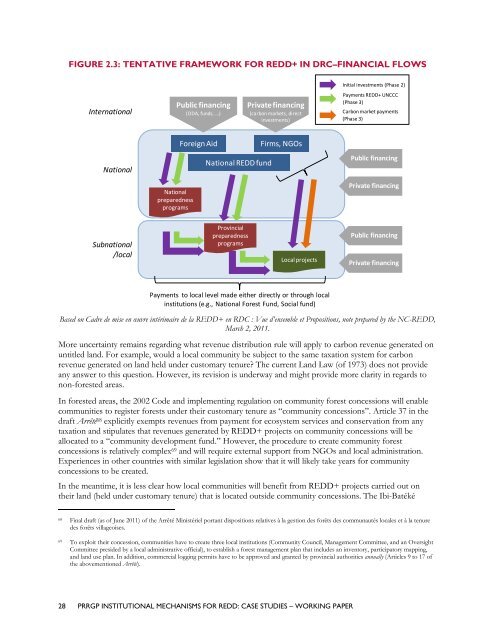

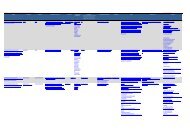

FIGURE 2.3: TENTATIVE FRAMEWORK FOR <strong>REDD+</strong> IN DRC–FINANCIAL FLOWS<br />

International<br />

National<br />

Subnational<br />

/local<br />

National<br />

preparedness<br />

programs<br />

Public financing<br />

(ODA, funds, …)<br />

Private financing<br />

(carbon markets, direct<br />

investments)<br />

Foreign Aid Firms, NGOs<br />

National REDD fund<br />

Provincial<br />

preparedness<br />

programs<br />

Local projects<br />

Payments to local level made either directly or through local<br />

institutions (e.g., National Forest Fund, Social fund)<br />

Based on Cadre de mise en œuvre intérimaire de la <strong>REDD+</strong> en RDC : Vue d’ensemble et Propositions, note prepared by the NC-REDD,<br />

March 2, 2011.<br />

More uncertainty remains regarding what revenue distribution rule will apply to carbon revenue generated on<br />

untitled land. For example, would a local community be subject to the same taxation system <strong>for</strong> carbon<br />

revenue generated on land held under customary tenure? The current Land Law (of 1973) does not provide<br />

any answer to this question. However, its revision is underway and might provide more clarity in regards to<br />

non-<strong>for</strong>ested areas.<br />

In <strong>for</strong>ested areas, the 2002 Code and implementing regulation on community <strong>for</strong>est concessions will enable<br />

communities to register <strong>for</strong>ests under their customary tenure as ―community concessions‖. Article 37 in the<br />

draft Arrêté 68 explicitly exempts revenues from payment <strong>for</strong> ecosystem services and conservation from any<br />

taxation and stipulates that revenues generated by <strong>REDD+</strong> projects on community concessions will be<br />

allocated to a ―community development fund.‖ However, the procedure to create community <strong>for</strong>est<br />

concessions is relatively complex 69 and will require external support from NGOs and local administration.<br />

Experiences in other countries with similar legislation show that it will likely take years <strong>for</strong> community<br />

concessions to be created.<br />

In the meantime, it is less clear how local communities will benefit from <strong>REDD+</strong> projects carried out on<br />

their land (held under customary tenure) that is located outside community concessions. The Ibi-Batéké<br />

68 Final draft (as of June 2011) of the Arrêté Ministériel portant dispositions relatives à la gestion des <strong>for</strong>êts des communautés locales et à la tenure<br />

des <strong>for</strong>êts villageoises.<br />

69 To exploit their concession, communities have to create three local institutions (Community Council, Management Committee, and an Oversight<br />

Committee presided by a local administrative official), to establish a <strong>for</strong>est management plan that includes an inventory, participatory mapping,<br />

and land use plan. In addition, commercial logging permits have to be approved and granted by provincial authorities annually (Articles 9 to 17 of<br />

the abovementioned Arrêté).<br />

28 PRRGP INSTITUTIONAL MECHANISMS FOR REDD: CASE STUDIES – WORKING PAPER<br />

Initial investments (Phase 2)<br />

Payments <strong>REDD+</strong> UNCCC<br />

(Phase 3)<br />

Carbon market payments<br />

(Phase 3)<br />

Public financing<br />

Private financing<br />

Public financing<br />

Private financing