Consumer Stuff for kids (PDF, 6.2 MB) - Consumer Affairs Victoria

Consumer Stuff for kids (PDF, 6.2 MB) - Consumer Affairs Victoria

Consumer Stuff for kids (PDF, 6.2 MB) - Consumer Affairs Victoria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

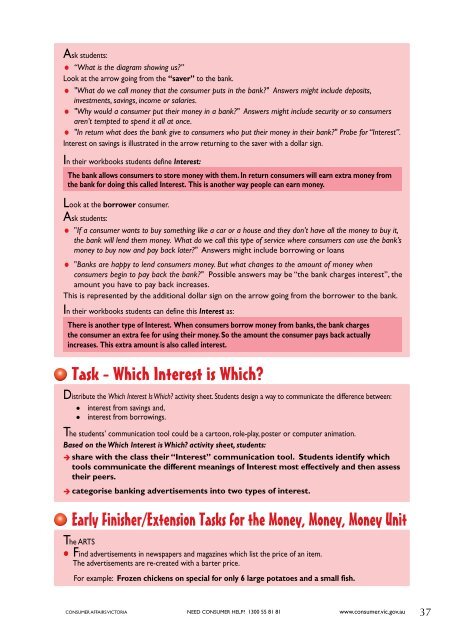

Ask students:<br />

“What is the diagram showing us?”<br />

Look at the arrow going from the “saver” to the bank.<br />

"What do we call money that the consumer puts in the bank?" Answers might include deposits,<br />

investments, savings, income or salaries.<br />

"Why would a consumer put their money in a bank?" Answers might include security or so consumers<br />

aren’t tempted to spend it all at once.<br />

"In return what does the bank give to consumers who put their money in their bank?" Probe <strong>for</strong> “Interest”.<br />

Interest on savings is illustrated in the arrow returning to the saver with a dollar sign.<br />

In their workbooks students define Interest:<br />

The bank allows consumers to store money with them. In return consumers will earn extra money from<br />

the bank <strong>for</strong> doing this called Interest. This is another way people can earn money.<br />

Look at the borrower consumer.<br />

Ask students:<br />

"If a consumer wants to buy something like a car or a house and they don’t have all the money to buy it,<br />

the bank will lend them money. What do we call this type of service where consumers can use the bank’s<br />

money to buy now and pay back later?" Answers might include borrowing or loans<br />

"Banks are happy to lend consumers money. But what changes to the amount of money when<br />

consumers begin to pay back the bank?" Possible answers may be “the bank charges interest”, the<br />

amount you have to pay back increases.<br />

This is represented by the additional dollar sign on the arrow going from the borrower to the bank.<br />

In their workbooks students can define this Interest as:<br />

There is another type of Interest. When consumers borrow money from banks, the bank charges<br />

the consumer an extra fee <strong>for</strong> using their money. So the amount the consumer pays back actually<br />

increases. This extra amount is also called interest.<br />

Task - Which Interest is Which?<br />

Distribute the Which Interest Is Which? activity sheet. Students design a way to communicate the difference between:<br />

• interest from savings and,<br />

interest from borrowings.<br />

•<br />

The students’ communication tool could be a cartoon, role-play, poster or computer animation.<br />

Based on the Which Interest is Which? activity sheet, students:<br />

share with the class their “Interest” communication tool. Students identify which<br />

tools communicate the different meanings of Interest most effectively and then assess<br />

their peers.<br />

categorise banking advertisements into two types of interest.<br />

Early Finisher/Extension Tasks <strong>for</strong> the Money, Money, Money Unit<br />

The ARTS<br />

Find advertisements in newspapers and magazines which list the price of an item.<br />

The advertisements are re-created with a barter price.<br />

For example: Frozen chickens on special <strong>for</strong> only 6 large potatoes and a small fish.<br />

CONSUMER AFFAIRS VICTORIA NEED CONSUMER HELP? 1300 55 81 81 www.consumer.vic.gov.au<br />

37