TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

TESTING INTERNATIONAL PRICE TRANSMISSION UNDER ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annexes<br />

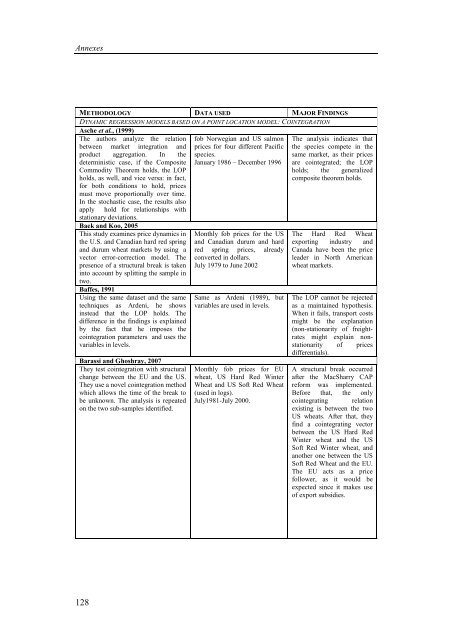

METHODOLOGY DATA USED MAJOR FINDINGS<br />

DYNAMIC REGRESSION MODELS BASED ON A POINT LOCATION MODEL: COINTEGRATION<br />

Asche et al., (1999)<br />

The authors analyze the relation<br />

between market integration and<br />

product aggregation. In the<br />

deterministic case, if the Composite<br />

Commodity Theorem holds, the LOP<br />

holds, as well, and vice versa: in fact,<br />

for both conditions to hold, prices<br />

must move proportionally over time.<br />

In the stochastic case, the results also<br />

apply hold for relationships with<br />

stationary deviations.<br />

Baek and Koo, 2005<br />

This study examines price dynamics in<br />

the U.S. and Canadian hard red spring<br />

and durum wheat markets by using a<br />

vector error-correction model. The<br />

presence of a structural break is taken<br />

into account by splitting the sample in<br />

two.<br />

Baffes, 1991<br />

Using the same dataset and the same<br />

techniques as Ardeni, he shows<br />

instead that the LOP holds. The<br />

difference in the findings is explained<br />

by the fact that he imposes the<br />

cointegration parameters and uses the<br />

variables in levels.<br />

Barassi and Ghoshray, 2007<br />

They test cointegration with structural<br />

change between the EU and the US.<br />

They use a novel cointegration method<br />

which allows the time of the break to<br />

be unknown. The analysis is repeated<br />

on the two sub-samples identified.<br />

128<br />

fob Norwegian and US salmon<br />

prices for four different Pacific<br />

species.<br />

January 1986 – December 1996<br />

Monthly fob prices for the US<br />

and Canadian durum and hard<br />

red spring prices, already<br />

converted in dollars.<br />

July 1979 to June 2002<br />

Same as Ardeni (1989), but<br />

variables are used in levels.<br />

Monthly fob prices for EU<br />

wheat, US Hard Red Winter<br />

Wheat and US Soft Red Wheat<br />

(used in logs).<br />

July1981-July 2000.<br />

The analysis indicates that<br />

the species compete in the<br />

same market, as their prices<br />

are cointegrated; the LOP<br />

holds; the generalized<br />

composite theorem holds.<br />

The Hard Red Wheat<br />

exporting industry and<br />

Canada have been the price<br />

leader in North American<br />

wheat markets.<br />

The LOP cannot be rejected<br />

as a maintained hypothesis.<br />

When it fails, transport costs<br />

might be the explanation<br />

(non-stationarity of freightrates<br />

might explain nonstationarity<br />

of prices<br />

differentials).<br />

A structural break occurred<br />

after the MacSharry CAP<br />

reform was implemented.<br />

Before that, the only<br />

cointegrating relation<br />

existing is between the two<br />

US wheats. After that, they<br />

find a cointegrating vector<br />

between the US Hard Red<br />

Winter wheat and the US<br />

Soft Red Winter wheat, and<br />

another one between the US<br />

Soft Red Wheat and the EU.<br />

The EU acts as a price<br />

follower, as it would be<br />

expected since it makes use<br />

of export subsidies.